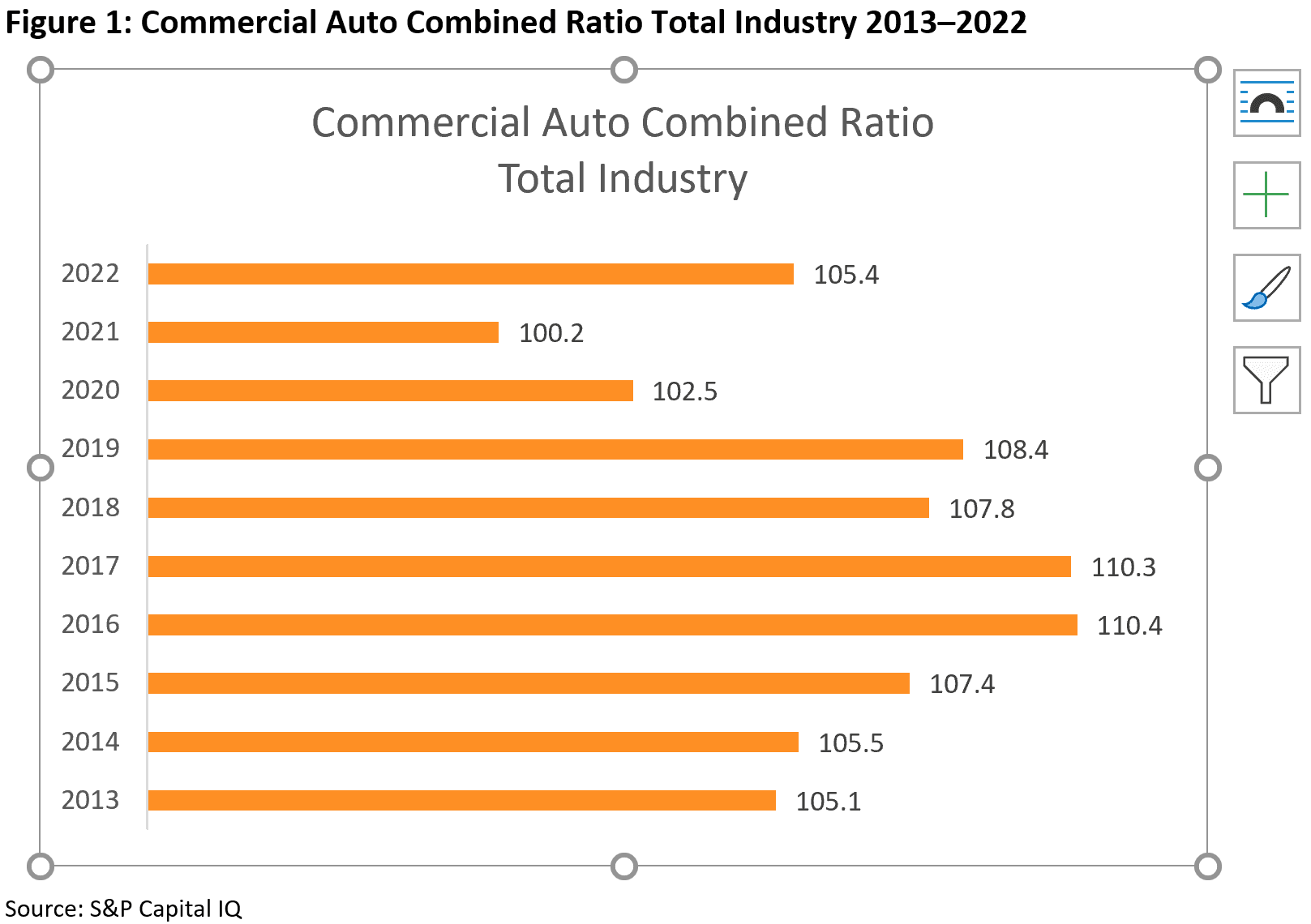

Commercial auto insurance in the United States has, in the aggregate, not been a successful line of business for a number of years. However, within the overall negative picture, there have been individual insurers that found ways to make an underwriting profit. And there has been a significant increase in the range and sophistication of connecting technologies available to fleet owners and fleet insurers. These technologies provide real-time and retrospective data that can be analyzed and used to provide loss mitigation and loss avoidance.

The question that this report addresses is whether all of these developments will enable commercial auto insurers to connect and turn the corner toward sustainable profitability.