This report discusses how banks are adopting new tools and technology such as artificial intelligence, machine learning, and robotic process automation in financial crime compliance operations. Based on interviews with several banks, it highlights benefits seen from early adoption and offers lessons for those considering this journey.

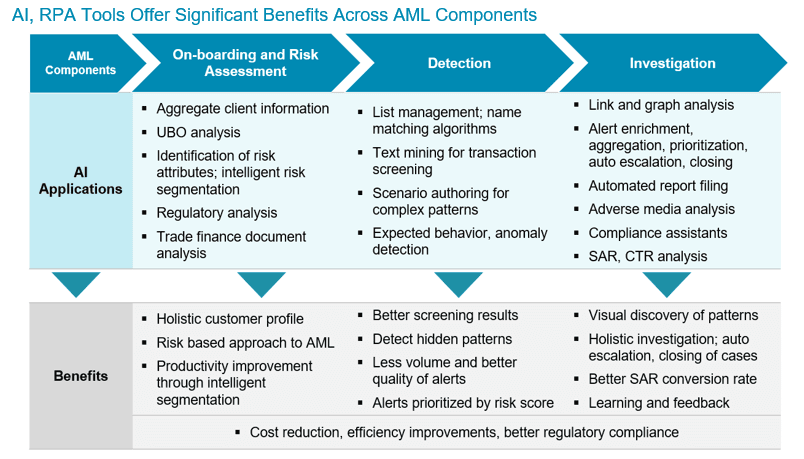

Advanced analytics and intelligent automation are being applied at several stages within anti-money laundering (AML) operations. Large global and regional banks are driving AI adoption with early focus on implementing point solutions. With growing maturity of users and solution providers, we expect leading banks to expand scope and conduct even more complex tasks.

Efficient data management is essential because AI solutions involve voluminous and diverse data sets. Model governance, validation, and documentation are paramount because of strict regulatory requirements.