The pressure on the buy side is intense . On the journey to managing operational and regulatory demands in a cost-effective way, investment management firms have already outsourced many of the functions of their back and middle offices. Today, for some firms, even the once untouchable front office is in play. In this report, we look at the trends and implications of the delivery of technology and services to the buy side in this shift to outsourced models. We explore the rationale for this shift, demand drivers, and the changing provider universe. In order to collect data and benchmark views, Celent spoke to a number of global asset managers and hedge funds that are considering or have already outsourced their trading function. Most had a mixture of asset classes but leaned toward equity. We also spoke to outsourcing providers, prime brokers, and technology providers active in this area.

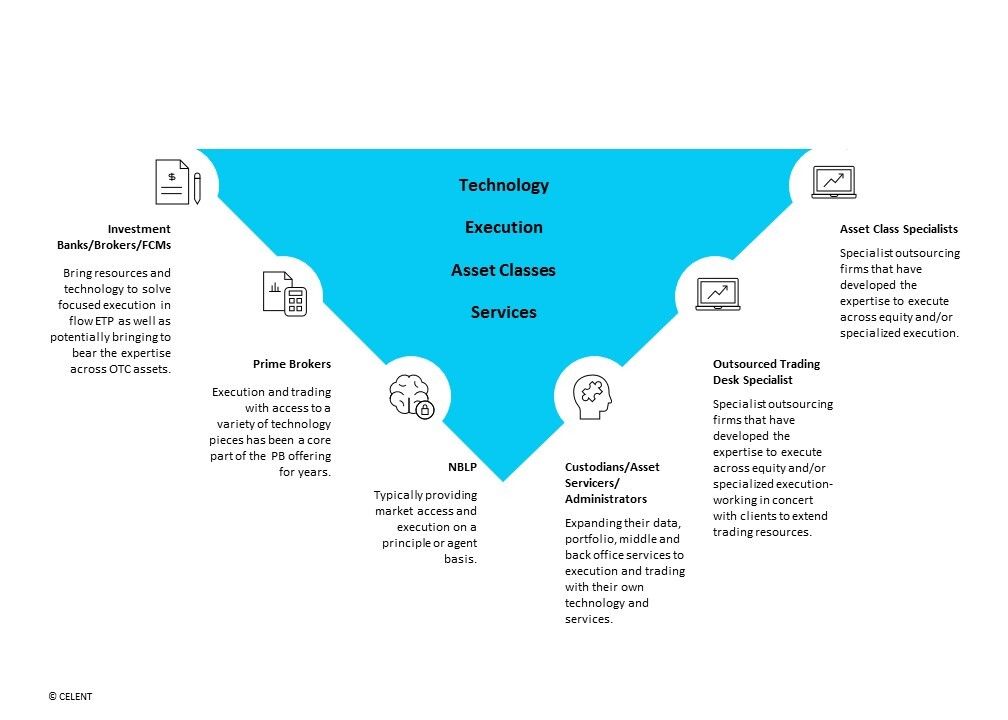

Choices of outsourcing partners