Once the exclusive domain of large enterprises, intelligent virtual assistants (IVAs) based on conversational artificial intelligence (CAI) are quickly moving down market. In retail banking, they are doing so largely through CAI specialist firms with prebuilt and tuned natural language understanding (NLU) models and intent libraries designed for quick time to value. In this report, Celent profiles 10 retail banking IVA platforms and rigorously compare them based on a detailed RFI, solution demos, and customer feedback.

IVAs have rapidly advanced in capability over the past few years alongside advances in natural language processing (NLP), natural language understanding, large language models (LLMs), generative artificial intelligence (AI), and a growing body of interaction data with which to train machine learning (ML) models. Originally confined to the text chat domain, many bots now fluently operate in the voice domain.

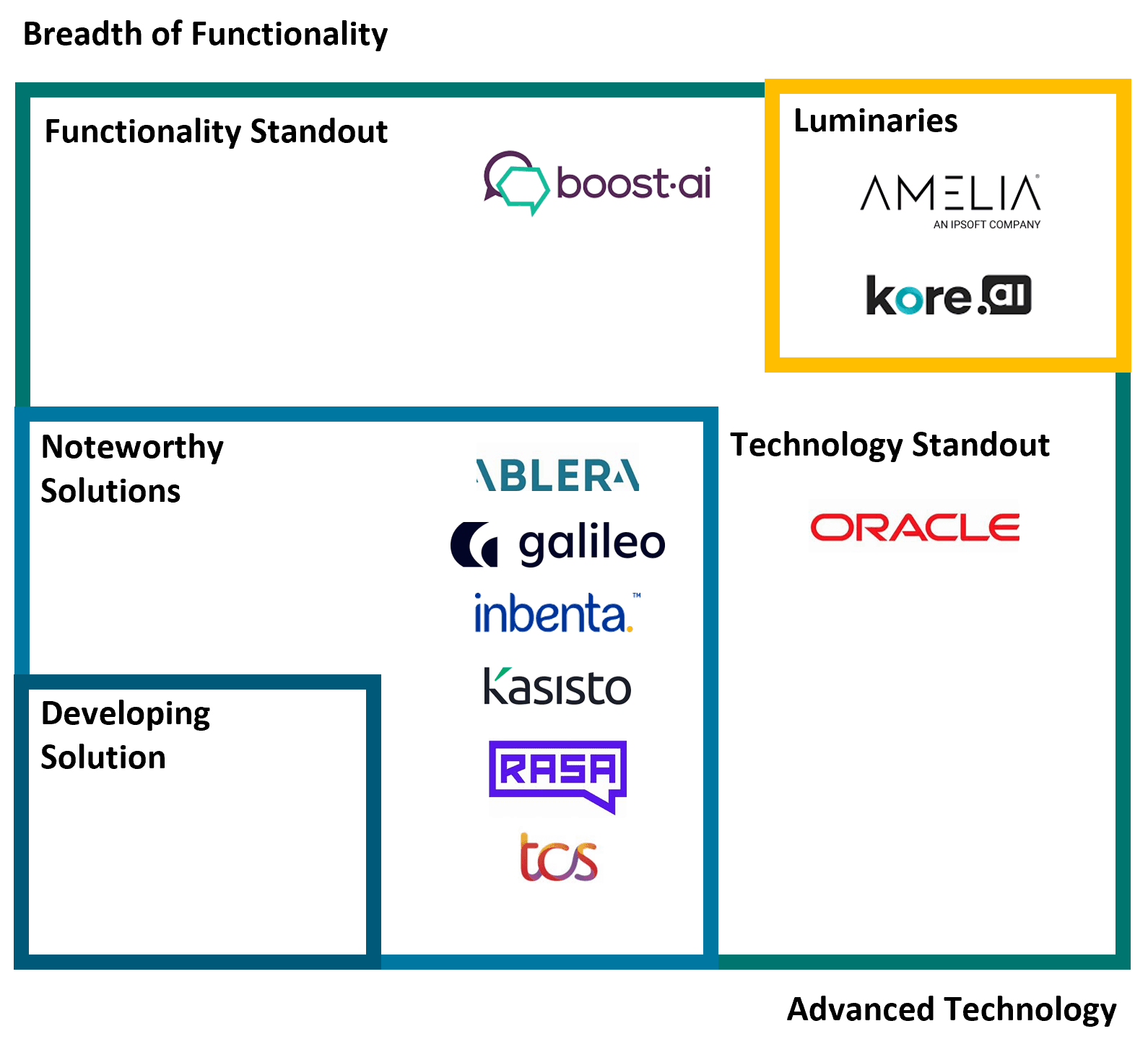

Celent distinguishes the vendors in two award categories:

- XCelent Award Winners: Celent selects the best of the best in areas of technology, functionality, and customer base and support.

- Celent Technical Capabilities Matrix: Celent places vendors into one of five categories based on the sophistication and breadth of their technology and functionality.

Within the Technical Capability Matrix, solutions are not ranked within the assigned category; they are listed alphabetically. The five categories are:

- Luminary: Excels in solution capabilities and typically excels in customer base and support; generally has a leading market presence.

- Technology Standout: Excels in technology modernity, although often without the same depth of features as leading competitors. Frequently newer, these solutions have chosen a focused set of functions with which to begin their journey.

- Functionality Standout: Excels in functionality and likely to have a large installed base. Often more established, these solutions have built out a robust set of features over many years.

- Noteworthy Solution: Potential challengers to the more established competition. They may occupy a niche place in the market, whether by targeted use case, sector-leading features, client size, or geography.

- Developing Solution: Typically new to the market. They may have the potential to mature into a market challenger.

This report should help retail banks to define their IVA platform requirements and, where appropriate, create a short list of vendors for further evaluation. Continually evolving functionality and improving technology mean that banks have a wide spectrum of vendors and platforms to consider when seeking a solution to fit their needs.