North American life insurers are finally, albeit slowly, automating their new business and underwriting processes. They are either implementing reinsurance rules engines to automate the underwriting decision on applications, or they are going all in with case management and underwriter dashboards along with their own rules that were built in vendor-provided underwriting rules engines. But how are these systems doing?

Celent looks at the customer feedback from last year's new business and underwriting vendor research and compares it with feedback from the previous two vendor reports. The analysis of the data points to some trends that are worthy of discussion. Life insurers see the need for automation in the new business process and vendors should be aware of the feedback to ensure they are meeting the insurers' needs.

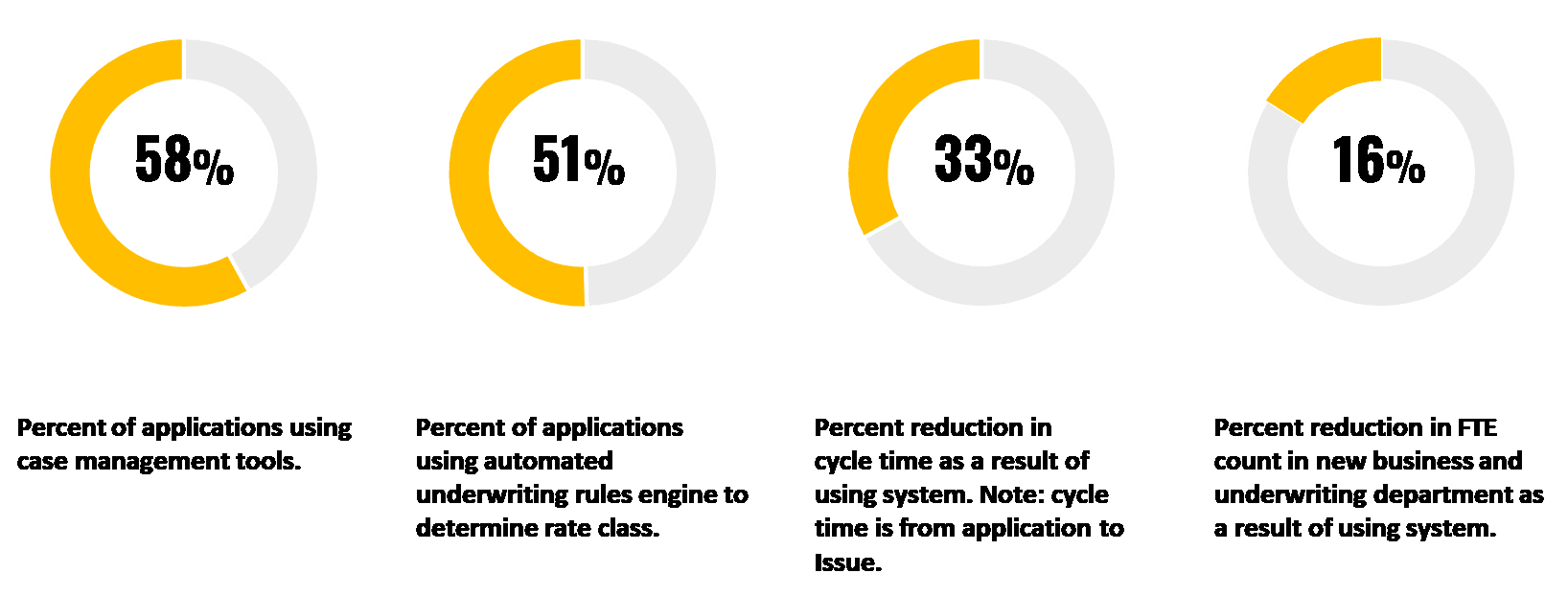

Key Metrics in New Business and Underwriting Usage and Outcomes