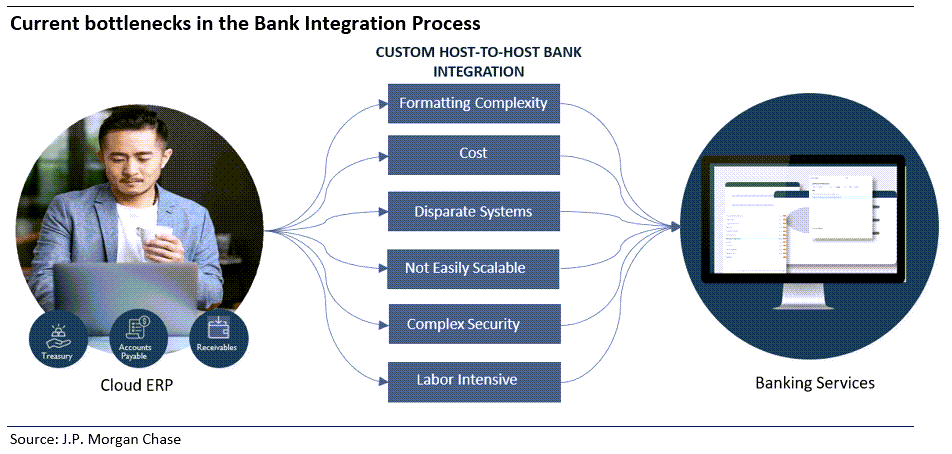

Integrating and embedding financial data into ERP and TMS systems lies at the heart of a modern treasury organization. However, outdated legacy systems, siloed technology teams, integration hurdles, and fragmented operational support have prevented seamless connectivity.

By leveraging embedded banking solutions, organizations can seamlessly deliver banking services directly into their ERP ecosystem, offering unparalleled convenience, data accuracy, and operational efficiency. This integration brings forth many benefits, including real-time visibility into financial data, automated transaction processing, and simplified reconciliation processes, all essential for optimizing financial management processes. Moreover, in today's rapidly changing macro environment, clients recognize the significance of enhancing flexibility to effectively respond to market dynamics. As a result, corporate clients seek a banking partner who can streamline the complexities of running and growing a business while providing timely intelligence to facilitate informed financial decisions.

In response to this growing customer demand, J.P. Morgan Payments has collaborated with two industry leaders, Oracle and SAP, to develop Integrated Digital Solutions. These cutting-edge real-time applications streamline end-to-end treasury processes. They not only deliver personalized digital banking experiences, but also automate transaction processing and simplify reconciliation processes through clients' ERP systems. As a result, they play a pivotal role in optimizing financial management processes and driving tangible business value.