Celent has released a new report titled Rearchitecting the Capital Markets: The Cloud Cometh. The report was written by Brad Bailey and Arin Ray, both with Celent’s Securities & Investments practice.

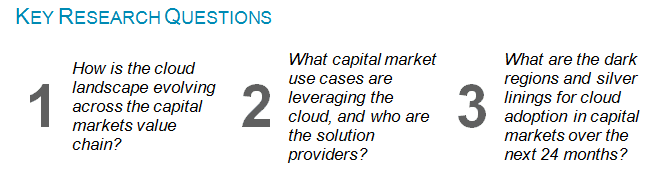

Cloud-based models are transforming capital markets. The report examines where major transformation is taking place, and how market participants and solution providers are utilizing the cloud to create new models for market data, trading, risk, and operations.

As the capital markets move forward, cloud is proving to be a great enabler in creating an automated, data-centric, AI future. The cloud has emerged to solve many of the current challenges, such as cost pressure, lack of scalability, flexibility, and innovation. It offers firms a more agile infrastructure that enables them to address ever-evolving regulatory requirements and the proliferation of trading applications, as well as the need to rapidly connect to multiple liquidity sources.

The implications for core IT infrastructure are profound. The cloud model is becoming the blueprint for infrastructure transformation across the front, middle, and back offices. In parallel, the capital market space is seeing a need for better connectivity. Private, dedicated cloud access is better suited for capital market requirements, offering better speed and latency as well as superior performance and security.

The public cloud is also gaining traction in strategically chosen functions and segments. The cloud cuts the cost of failure and allows firms large and small, as well as fintech providers, to test alternative business models in a low-risk manner.

“Saving money is only the starting point with the cloud. The end game is a new type of data-centric, analytically robust capital market firm,” commented Bailey, a Research Director.

“The cloud sits at the center of all major trends we see today in the capital markets: cost reduction, focus on core, automation, operational efficiency, data primacy, analytics, and machine learning,” added Ray, an Analyst.