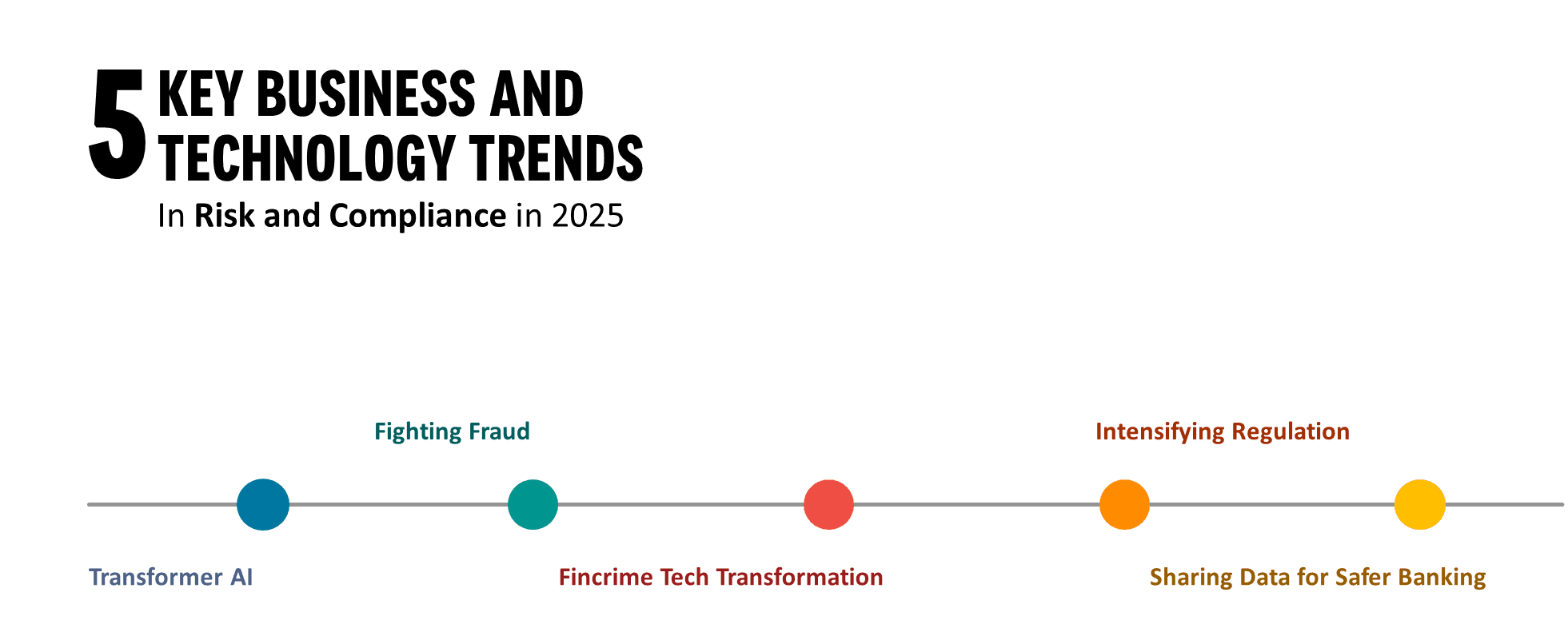

Celent's Risk and Compliance priorities for 2025 examine impactful technology and regulatory trends within the domains of anti-financial crime, operational resilience and other risk functions.

Looking ahead to 2025, AI stays at the top of our list of R&C priorities. Banks more clearly understand GenAI and are finding new ways to apply it. As its applicability moves beyond LLMs, we need a new perspective that looks at Transformer Technology as a whole and reflects broader use.

2025 will be a particularly intense year in terms of regulation across all risk functions. As a result, we are building regulation as an explicit item into our previsory this year. Regulatory change management technology, turbocharged by generative AI, can help financial institutions integrate the onslaught of regulation into policies, procedures, operations and corporate risk strategies.

Regulatory and technology evolution are both driving the use of AI for anti-financial crime, including financial crime compliance, anti-fraud and surveillance. Celent sees 2025 as the year that adoption of AI for AFC comes of age, led by pathbreaking Tier 1 institutions who are seeing increasingly tangible results from mature AI technologies such as machine learning and are actively exploring the potential of LLMs and other transformer-based technologies such as LTMs.

1. Transformer AI

The use of generative AI in Risk functions is moving beyond LLMs to hybrid and quantitative techniques leveraging transformer-based foundation models. Emerging modes include:

- Coupling LLMs with machine learning

- Agentic/Multi-Agent systems

- Quantitative foundation models

- Multi-modal AI

2. Fighting Fraud

- Uptick in online activity during the pandemic has changed consumer habits in a way that results in increased vulnerability to fraud

- Fraud levels increased during the covid pandemic, and they have remained high and continued to grow

- Increased accessibility to AI tools since ChatGPT’s release in November 2022 have fueled both fraud’s proliferation and anti-fraud tech’s advancement

3. Fincrime Tech Transformation

- Adoption of artificial intelligence for financial crime compliance is coming of age

- Tier 1s see increasingly tangible results from machine learning and are exploring GenAI

- A range of advanced technologies have a role to play in the transformation of analytics and infrastructure for financial crime compliance

4. Intensifying Regulation

- Volume of regulations continues to accelerate particularly with regard to non-financial risk

- Four trends in NFR regulation

- GenAI presents financial institutions with a step change in terms of coping with this accelerated pace

5. Sharing Data for Safer Banking

- Machine learning is increasingly used in detecting financial crime. More data builds better models

- By sharing data, banks can enhance the efficacy of AI systems in detecting suspicious activities. New regulations are being put in place to encourage such sharing

- Privacy-enhancing technologies (PETs) are being compared to allow banks to share data without revealing personally identifiable information (PII)