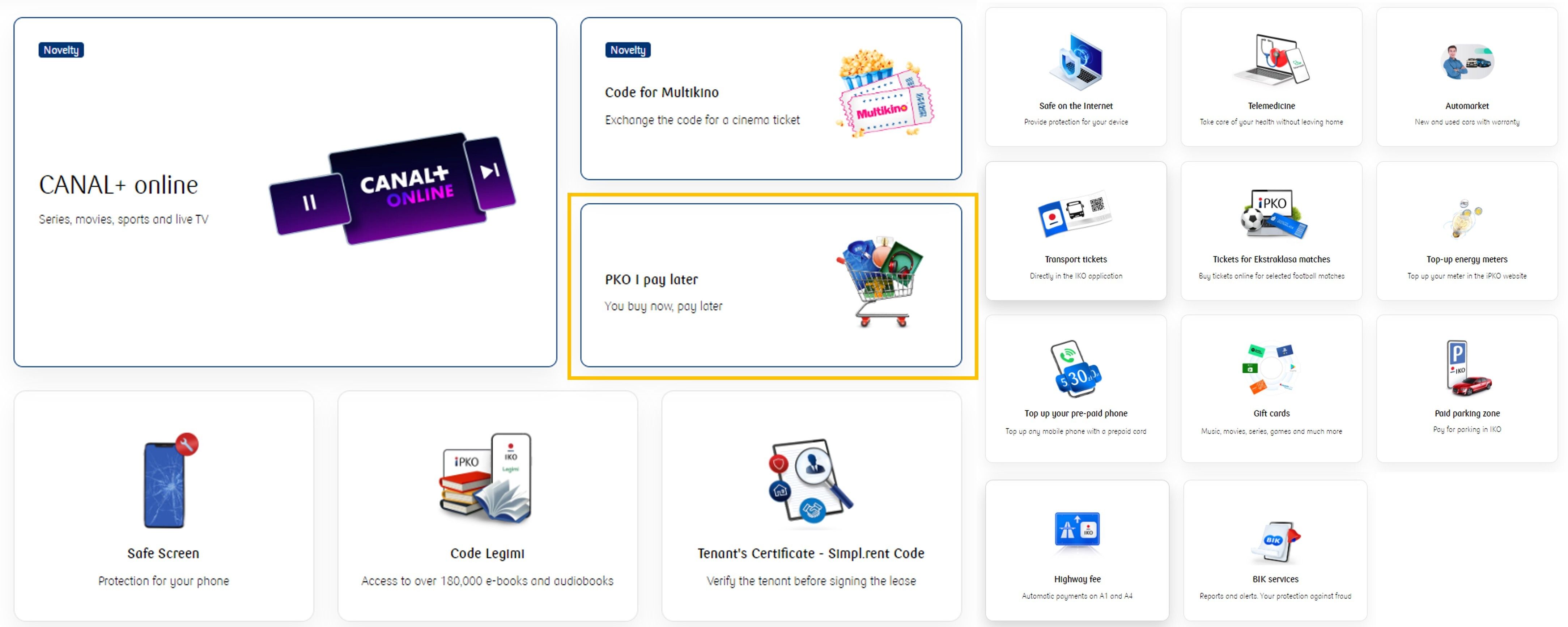

For PKO Bank Polski, additional services are an important element of enriching and making the main banking proposition more attractive. The new Value-Added Services Platform offers universal technology for suppliers (API) and a unified purchasing and service process for customers.

Banking customers these days are increasingly more demanding: they don’t just want a good standard product; they want choice and control, with the ability to customise the offering. When engaging with their financial institution, they don’t just want smooth experiences; they want them personalised and tailored to their preferences. The Celent Model Bank Empowering the Customer award recognises a financial institution’s commitment and efforts to put customers in the driving seat by delivering choice, control, and superior experiences.

PKO Bank Polski demonstrated such commitment with two separate initiatives: PKO Pay Later and Value-Added Services Platform. This is Part II of the award-winning case study, which profiles the Value-Added Services Platform. Part I covers PKO Pay Later.