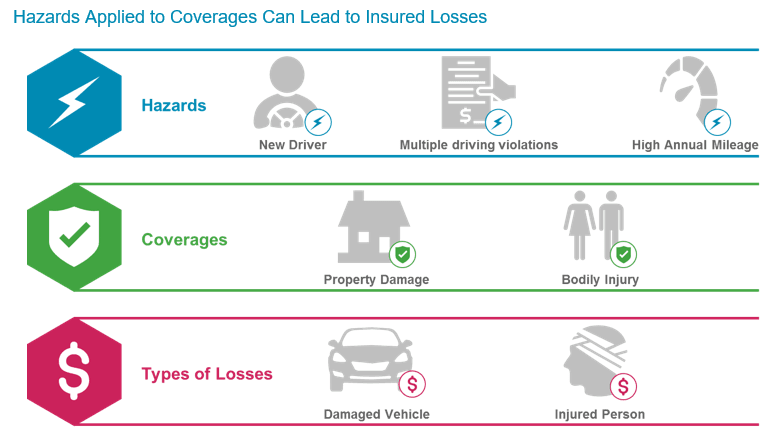

To be successful, an insurer has to correctly estimate the probability of losses. To do that, the insurer collects information about risks and other factors, whose presence increases the probability of losses. For a very long time, the collection of such information has been done manually.

However, things are changing. Insurers are using new technologies which automate the assessment of risks and sharpen loss probability estimates.

These new types of hazards prominently include bad actors who, acting with intent, try to inflict losses on organizations and individuals.

Cyber losses fall into three categories: affirmative, silent, and direct. Examples of affirmative coverages, endorsements, and breach response services are provided for three leading cyber insurers.