New York, NY, USA June 17, 2008

An extensive study from Celent compares and ranks execution venues for NYSE stocks.

With Regulation NMS safely in place, execution quality in the US equities markets has experienced tremendous improvement. From 2006 to 2008, market centers’ average execution speeds for NYSE-listed equities have fallen by a stunning 92% in least active issues as electronification gains greater ground.

In a new report, , Celent analyzes over 15.9 billion orders over the period of December 1, 2007 through February 29, 2008. In total, the report by Octavio Marenzi, head of Celent, and Chermaine Lee, analyst with Celent’s Securities & Investments group, measures and ranks 176 market participants according to their execution speed and prices obtained for incoming orders.

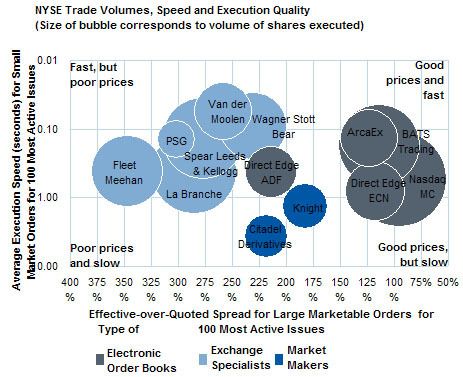

As in Celent’s previous findings, there is no real observable tradeoff between speed and price factors in execution quality. Moreover, execution venues’ average speed quality seems to be converging, as the standard deviation in this period was 0.14 versus 0.85 in the previous report. On the contrary, price quality among the largest market centers may be diverging: the standard deviation increased by 178%.

Overall, BIDS Trading had the best prices among all market centers while Liquidnet topped the speed rankings.

| Price Ranking | Market Center | Speed Ranking | Market Center |

| 1 | BIDS Trading | 1 | Liquidnet |

| 2 | Liquidnet | 2 | PHLX |

| 3 | National Financial | 3 | CHX Matching |

| 4 | EBX | 4 | Lehman Bros. (LATS) |

| 5 | NYFIX | 5 | Nasdaq MC |

| Source: Celent analysis | |||

Among electronic order books, Nasdaq MC achieved the best prices and the fastest speed, displacing ArcaEx for the title of quickest major electronic order book in our study. ATD obtained the best prices for client orders, while Knight executed incoming orders at the fastest rate in the market maker category. For exchange specialists, Wagner Stott Bear edged past Van Der Moolen for the top spot in the price rankings, whereas La Branche had the highest execution speed.

| Price Ranking | EOB | Speed Ranking | EOB |

| 1 | Nasdaq MC | 1 | Nasdaq MC |

| 2 | ArcaEx | 2 | ArcaEx |

| 3 | Direct Edge | 3 | BATS Trading |

| 4 | BATS Trading | 4 | Direct Edge |

| 5 | LavaFlow | 5 | LavaFlow |

| Source: Celent analysis | |||

| Price Ranking | Market Maker | Speed Ranking | Market Maker |

| 1 | ATD | 1 | Knight |

| 2 | E*Trade | 2 | ATD |

| 3 | Knight | 3 | Citadel |

| 4 | UBS | 4 | E*Trade |

| 5 | Citadel | 5 | UBS |

| Source: Celent analysis | |||

| Price Ranking | Exchange Specialist | Speed Ranking | Exchange Specialist |

| 1 | Wagner Stott Bear | 1 | La Branche |

| 2 | Van der Moolen | 2 | Spear Leeds |

| 3 | Banc of America | 3 | Wagner Stott Bear |

| 4 | Spear Leeds | 4 | Banc of America |

| 5 | La Branche | 5 | Van der Moolen |

| Source: Celent analysis | |||

The 42-page report contains 24 figures and nine tables. A table of contents is available online.

Members of Celent's Securities & Investments research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.