Earlier this month industry press was abuzz with reports that the EU will be introducing T+1 towards the end of 2027. Articles in a range of publications reference a public hearing hosted by the European Securities and Markets Authority (ESMA) and attended by EU officials including Sebastijan Hrovatin the European Commission policy officer. Sebastijan has been quoted as saying that the “Q4 2027 is realistic” for the shift to happen. Additionally, 70% of the people polled at the ESMA meeting said they favoured this timeframe.

The US of course has recently moved to T+1 this year and according to industry feedback the move has gone fairly smoothly. At the hearing a DTCC presentation noted that US trade failure rates have been “broadly consistent” after T+1 was implemented. An analysis from CLS, the world’s largest FX clearing house, found that average daily volumes remain stable with no decrease one month on from the T+1 live date of May 28 this year.The UK has also mooted a move to T+1 “before the end of 2027”.

Prior to the US live date, capital markets participants including asset managers, banks and trade groups had indicated in response to an ESMA consultation (launched October 2023) that worries about the EU migrating to T+1 remain. The ESMA summary feedback report stated “views on whether T+1 should be pursued are rather mixed.”

As my colleague, Dayle Scher’s recent research on this topic found, the concept of shortening the settlement cycle is not new but has received renewed impetus recently, fueled by technological advancement, increased market volatility and a growing emphasis on reducing systemic risk. The benefits are compelling including enhanced liquidity and reduced counterparty and credit risks. However, our research found a need for substantial technology improvements. As the UK and EU continue on this journey, Celent subscribers can access Dayle’s recent report, “Settling for Success in Implementing T+1” for in-depth analysis on the

- Benefits of accelerated securities settlement

- Challenges in implementation

- Technological innovations requirements

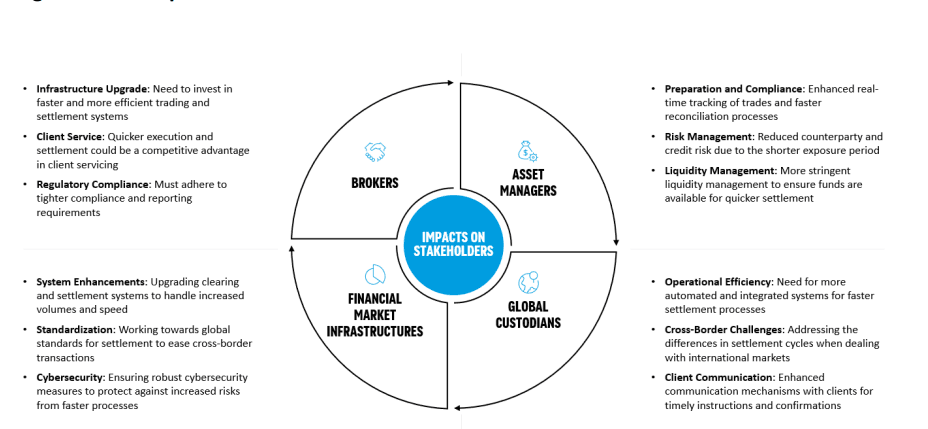

The Impact of T+1 on Stakeholders

source: Celent