Platform banking as a business model will become a force in the US that will dramatically change the competitive landscape. Given the unique characteristics of banking, banks will not follow the platform strategy playbook of the digital giants like Apple and Facebook. Instead, they will develop and adopt hybridized versions.

There has been much buzz in Europe about open banking ever since open application program interfaces (APIs) were mandated. What of the US, where there is no mandate? Are there market and/or other forces which will drive banks toward a platform strategy, one broader than open APIs? The resounding answer is yes.

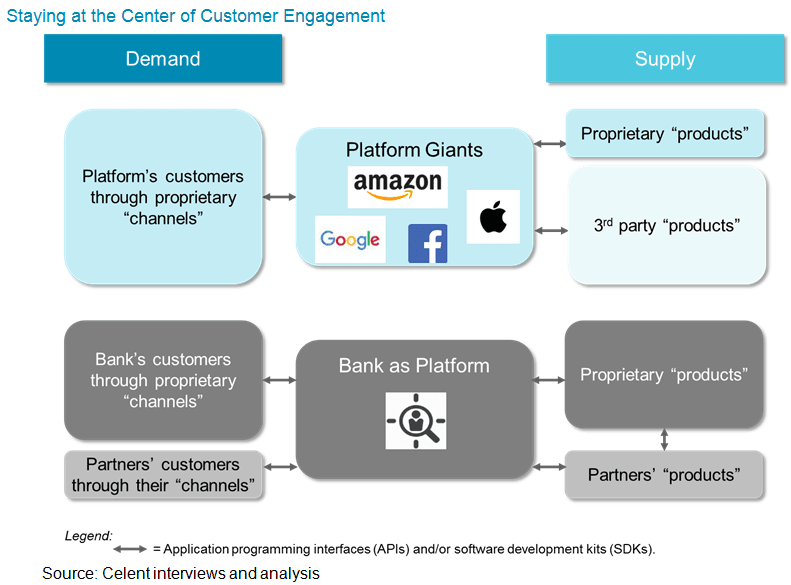

Given the unique characteristics of banking, banks should not follow the platform strategy playbook of the platform pioneers. On the demand side, banks should seek to acquire and serve customers not only through their channels but also through partners’ “channels.” On the supply side, they should integrate partners’ “product” into their channels, typically by white-labeling but occasionally co-branding.

Banks that harness the power of the platform model will generate a win-win through partnerships that will enable them to break resource constraints, accelerate scaling, and generate new revenue pools.