New York, NY, USA January 9, 2009

An extensive study from Celent compares and ranks execution venues for NYSE stocks.

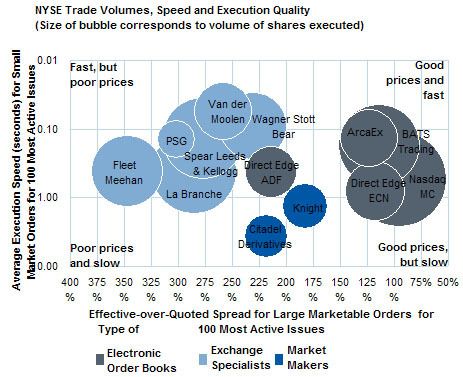

In a new report, Execution Quality in the NYSE Market, Celent examines the execution quality achieved by market centers for NYSE-listed securities for the period July 1, 2008 to September 30, 2008. A total of 179 market participants covering more than 18.8 billion orders for over 7 trillion shares were measured and ranked by Octavio Marenzi, head of Celent, and Chermaine Lee, analyst with Celent’s Securities and Investments group according to the execution speed and prices.

Overall, market centers’ frequency of price improvement has increased for all types of venues since the last report, which covered the period December 2007 to March 2008. Electronic order books have gained ground by growing their share of the NYSE market from almost 25% to more than 40%. On the other hand, exchange specialists have experienced the most significant fall in market share from 65.6% to 44.4%.

Overall, BIDS Trading retained its leading price performance in NYSE-listed issues from the last execution ranking, while alternative trading system-turned-exchange BATS Trading was ahead in the speed rankings.

| Price Ranking | Market Center | Speed Ranking | Market Center |

| 1 | BIDS Trading | 1 | BATS Trading |

| 2 | EBX | 2 | Nasdaq MC |

| 3 | NYFIX | 3 | ArcaEx |

| 4 | E*Trade Cap Mkt | 4 | Van der Moolen |

| 5 | Nasdaq MC | 5 | Direct Edge (ADF) |

| Source: Celent analysis |

In this report, Nasdaq MC (Nasdaq Market Center) achieved the best prices, whereas BATS Trading retained its top speed ranking in this study among major electronic order books. In the market maker category, E*Trade Capital Markets achieved the best prices for client orders, while Knight executed incoming orders at the fastest rate. With Susquehanna dropping its services and Van der Moolen being bought over by Lehman Brothers (now Barclays Capital), there has been a shakeup among the NYSE specialists. La Branche and Van der Moolen ranked first among their peers in the cumulative price and speed tables.

| Price Ranking | Major EOB | Speed Ranking | Major EOB |

| 1 | Nasdaq MC | 1 | BATS Trading |

| 2 | ArcaEx | 2 | Nasdaq MC |

| 3 | Direct Edge ECN | 3 | ArcaEx |

| 4 | BATS Trading | 4 | Direct Edge ECN |

| 5 | LavaFlow | 5 | LavaFlow |

| Source: Celent analysis |

| Price Ranking | Major Market Makers | Speed Ranking | Major Market Makers |

| 1 | E*Trade Capital Markets | 1 | Knight |

| 2 | Citadel Derivatives UBS Securities | 2 | UBS Securities |

| 3 | Getco Execution Services | 3 | ATD |

| 4 | ATD | 4 | Citadel Derivatives |

| 5 | Citadel Derivatives | 5 | E*Trade Capital Markets |

| Source: Celent Analysis |

| Price Ranking | Major Specialists | Speed Ranking | Major Specialists |

| 1 | La Branche | 1 | Van der Moolen |

| 2 | Wagner Stott Bear | 2 | Wagner Stott Bear |

| 3 | Spear Leeds & Kellogg | 3 | Spear Leeds & Kellogg |

| 4 | Van der Moolen | 4 | La Branche |

| 5 | Banc of America Specialists | 5 | Banc of America Specialists |

| Source: Celent Analysis |

The 38-page report contains 23 figures and 9 tables. A table of contents is available online.

of Celent's Securities & Investments research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.