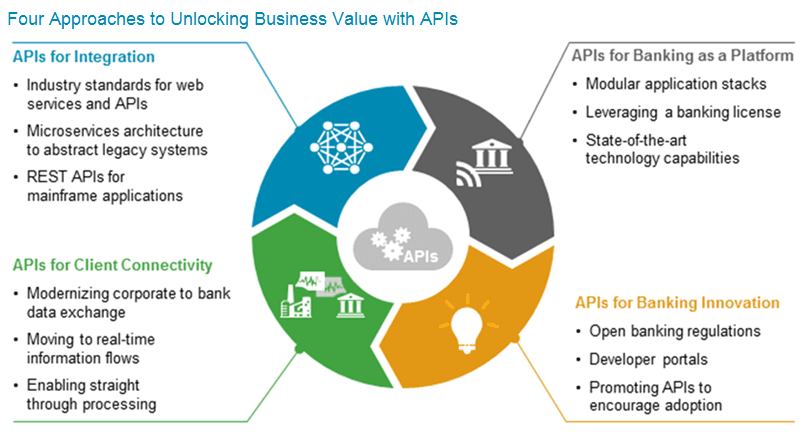

Banks must think beyond regulatory minimums when considering Open Banking APIs. Read more about how forward-looking banks are unlocking business value with APIs for application integration, banking as a platform, innovation, and client connectivity.

With regulatory initiatives well underway in the Euro Zone and the UK, it is clear that open banking APIs are inevitable. APIs are critical technology enablers for several use cases in banking including application integration, banking as a platform, innovation, and client connectivity.

Web services, microservices, and APIs enable legacy modernization by wrapping legacy systems with a decoupled integration layer, bridging traditional batch-based processes to real-time, digital cloud, mobile, and social applications. APIs enable the modular application stack underlying Banking as a Platform and provide neobanks with state-of-the-art digital banking capabilities. As open banking grows, driven by regulatory imperatives, shifting customer demands, and the threat of fintech firms, APIs connect banks and third party firms entering into collaborative partnerships for innovation. To access banking services, most customers manually log in to a web-based or mobile platform, pulling balance and transaction data on demand. APIs are emerging as a new connectivity channel, streamlining and securing on-demand, programmatic access to financial data for accounting packages, treasury management systems, and ERP platforms.

We offer updated case studies from CBW Bank, Fidor Bank, JB Financial Group, Citi, and YES BANK detailing their API journey, including technology architecture, monetization approach, and latest results. For banks seeking to begin their API journey, we recommend a series of guideposts that they can follow to unlock business value with APIs.