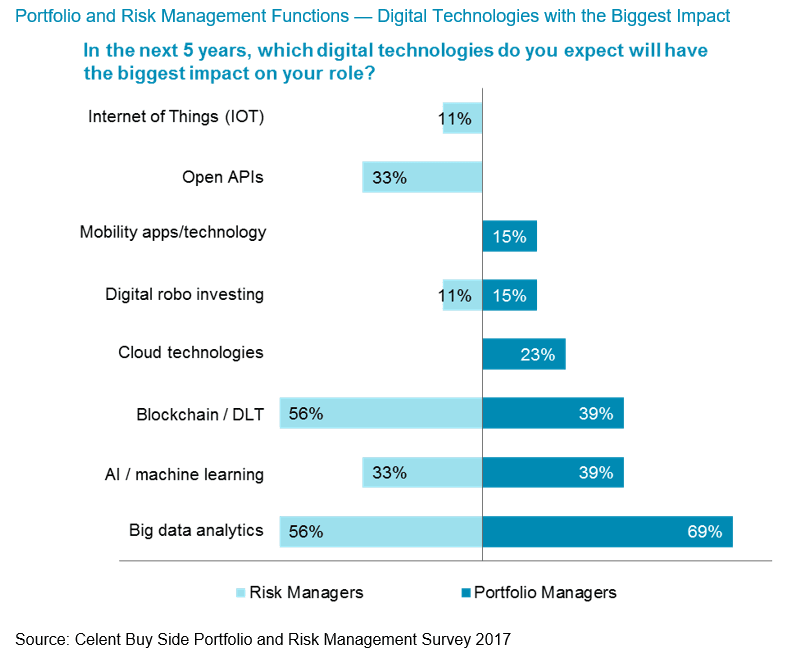

Based on our most recent investment technology survey insights, Celent examines how evolving business trends are altering portfolio and investment risk management practices, technology requirements, and future IT expenditures associated with front office and enterprise risk analytics for asset managers, pension funds, insurers, hedge funds, and other investment firms.

For this first report in the Next-Generation Portfolio and Investment Risk Capabilities series, Celent examines dynamics that are altering portfolio and investment risk management requirements, next-generation technology practices, and future IT expenditures associated with front office and enterprise risk for asset managers and asset owners.