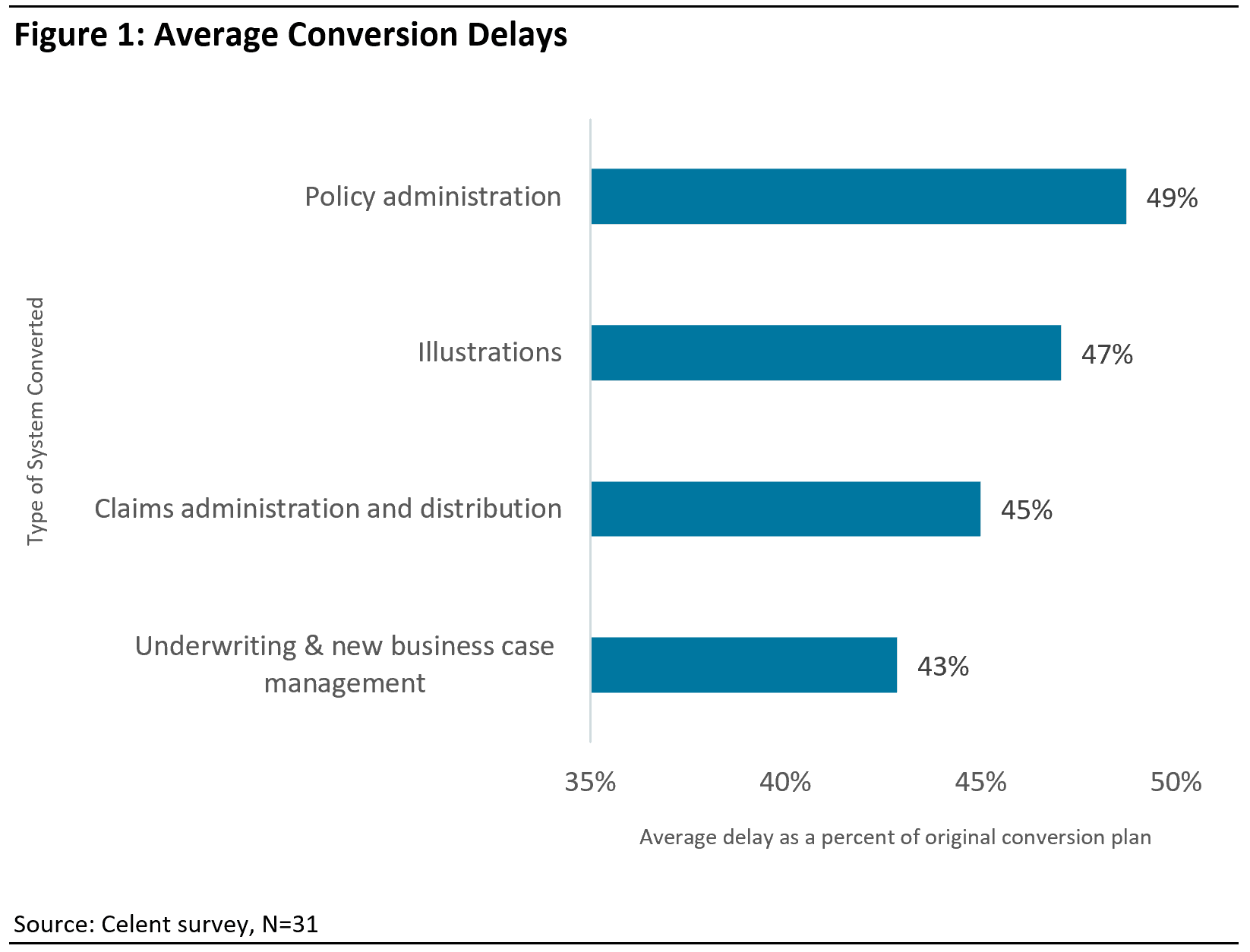

It’s common to hear the refrain “conversions are risky, expensive, and are never on-time!" Well, we wanted to know if the caution is still warranted. The survey[1] we conducted for this report is clear: there are significant risks—94% of our respondents experienced a material delay, with the most serious delays (see Figure 1) occurring with core systems like policy administration systems (PAS), at smaller carriers. However, the study also revealed reasons for optimism and better outcomes—the root causes we’ve uncovered can be addressed, and there are new tools and methods available that reduce risks and improve outcomes.

[1] Celent surveyed 31 insurance companies for this report—24 of which are in North America (NA), and 7 are from outside of NA.