TPPs are a direct threat to the lending, deposit and payment revenues of retail banks in Europe. While it is easy to view third party providers (TPPs) as offering little more than account aggregation and financial managment apps, nothing could be further from the truth. A large number have business models and propositions focused directly on capturing payment transaction volumes, lending and deposit business from incumbent banks. In almost all cases, these offerings leverage the customer data assets and payment products that banks already have.

Open banking remains in its infancy, meaning that there is time for banks to respond. However, this window is rapidly closing. While TPPs do represent a potential competitive challenge, they are also potential innovation partners (and many already work with banks or count them as investors). At the same time, almost all the product offerings highlighted in this report could also be emulated by financial institutions. It should not be forgotten that banks arguably have the most to gain from open banking, should they take advantage of the opportunities it presents.

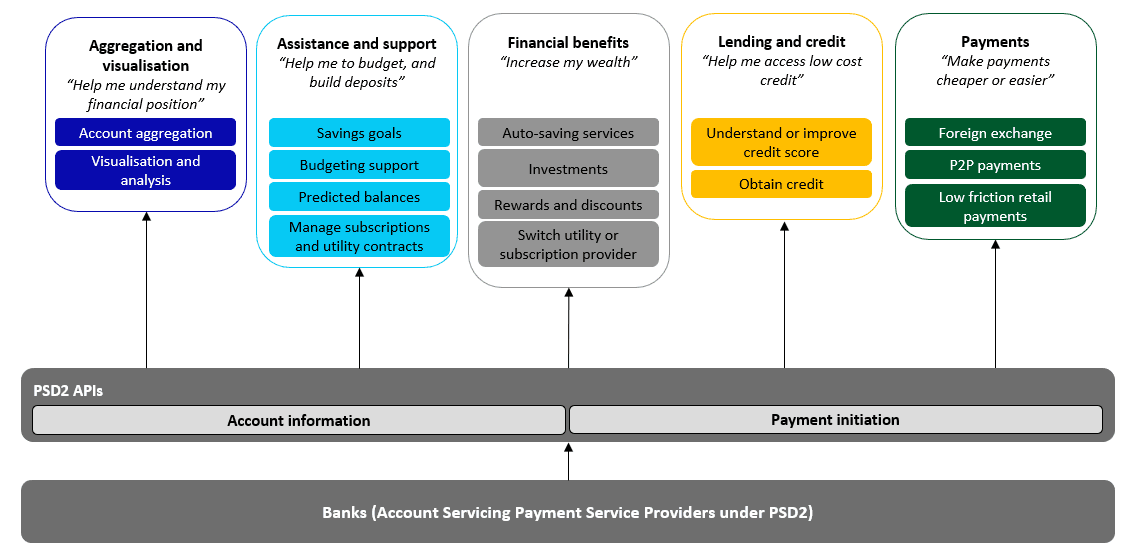

This report identifies 15 specific product offerings, spread across the 5 customer pain points that TPPs in Europe currently address:

- Aggregation and Visualisation: "Help me understand my financial position"

- Assistance and Support: "Help me to budget and build deposits"

- Financial benefits: "Increase my wealth"

- Lending and credit: "Help me access low cost credit"

- Payments: "Make payments cheaper or easier"

As such, this provides a framework for banks to assess competitive challenges from this segment as well as highlighting a number of innovative use cases around the analysis of transaction and account data.