Risk management technology spending is accelerating worldwide, driven by a combination of regulatory change, technological development, and macroeconomic challenges. In 2023 Risk IT spending grew 4.4% year over year to reach US$57.1 billion, with 2024 growth projected at 4.9% to reach US$59.9 billion. According to our recent surveys, risk management executives report that technology investments in anti-financial crime, AI governance and AI readiness, and emerging risks are top priorities. Risk functions are finding it necessary to use new tech to strengthen their data architecture and improve effectiveness in anti-financial crime (AFC) and other Risk functions.

This report, based on data from Celent surveys, provides our estimates of investments in Risk technology by banks worldwide, including both retail banks and corporate banks. The report presents global estimates and breakdowns including:

- Spending by global region: North America, Europe, Asia, and the Rest of the World.

- Technology spending breakdown by: external software, external services, internal spending and hardware/infrastructure.

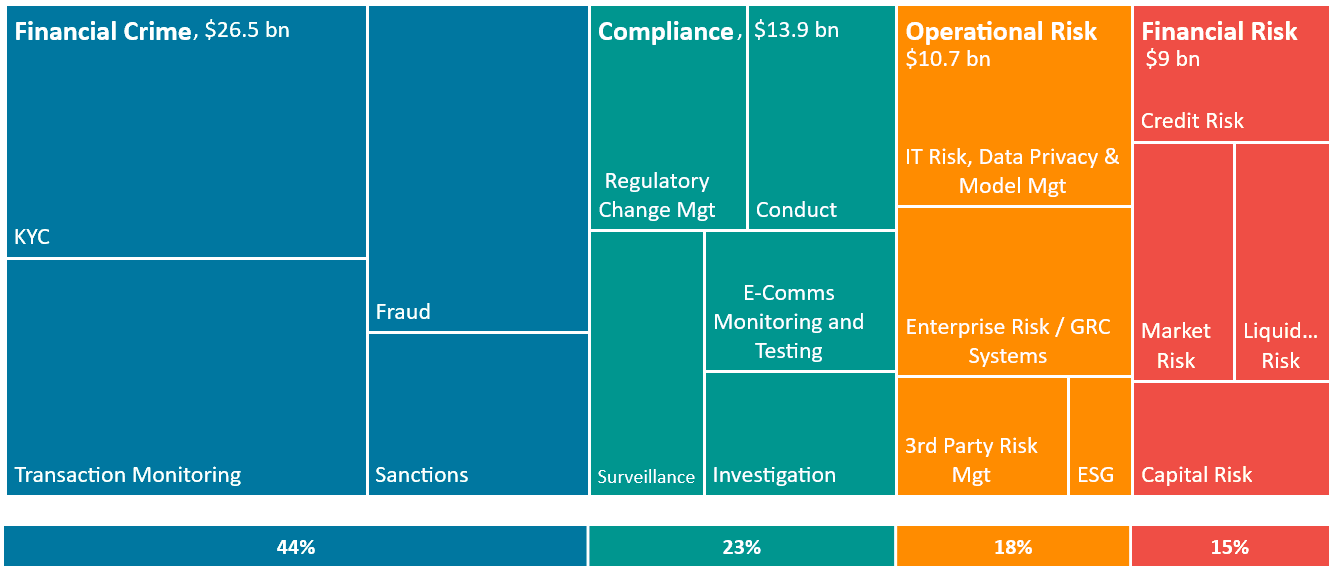

- Functional area spending trends: anti-financial crime, compliance, operational risk, and financial risk.

- Key technology trends and imperatives for banks and solution providers in 2024.