Every minute of every day, the digital channel is providing value for a financial institution. A day in the digital channel at a mid-sized US bank might include over 2,000 mobile deposits, more than 80,000 mobile logins, and upwards of 50,000 money-moving transactions. Any system outage is extremely damaging to transaction flow and customer experience.

But what is the value of one additional hour of platform availability?

When considering the net cost of digital platform investments, leaders should not overlook the real, measurable value of platform stability. Quantitative tracking of dollar and transaction volumes on an hourly basis is a critical first step. Transactions that are delayed, deflected, or deferred because of channel outages incur real costs to the organization and should be balanced against investments to improve monitoring, recovery, and processing efficiency.

Half of all FIs in Celent’s recent survey of North American retail banks and credit unions are not measuring transaction volumes at an hourly rate, leaving a large blind spot when it comes to understanding the true cost of even short-lived channel disruptions.

This is an opportunity for digital leaders to communicate to their organization, in dollar terms, just how much system availability matters. Channel and product owners should understand how to manage high availability, what the value of that availability is to the organization, and how to communicate that value effectively.

Managing for high availability

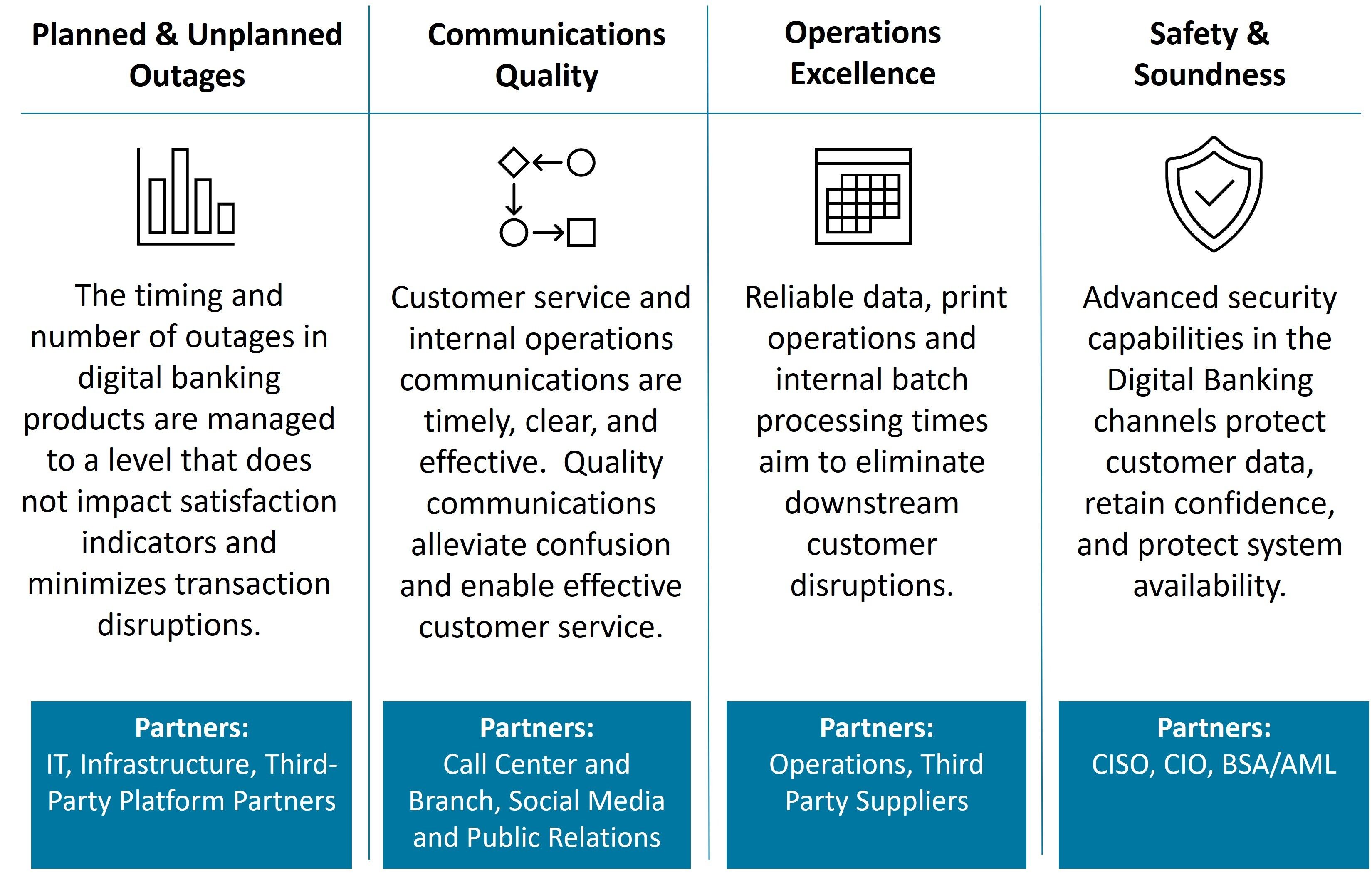

There are at least four components that support highly available digital platforms. These can vary depending on the ownership of the digital platform (bank or third-party service) and on internal organization structure, but in general:

Availability starts with digital banking stability and performance but expands into communications quality and timeliness, operations reliability including third-party processors, and security, safety, and soundness initiatives. All of these ladder up to a highly available customer experience that reduces transaction delay, deferral, or deflection.

The Value of Higher Availability

To measure the value of platform availability, digital leaders should analyze historical transaction volumes or obtain them from existing monitoring data, including any digital experience monitoring (DEM) tools in use. A simple scorecard can be developed to immediately understand the impact of an outage. At a minimum, two important value sets should be known:

1. Engagement Levels by Time of Day / Day of Week: Using web and mobile analytics tools, evaluate login volumes that fluctuate predictably throughout times of day and on weekends.

2. Projected Transaction Volumes: Using monthly or other available transaction volume data, approximate likely volumes by time of day, distributing along the engagement curve from the previous step. Here you can use "projected" impact, based on similar recent-period activity, to predict "lost" activity during any outage period.

Once these values are understood, a table can be maintained for reference:

ILLUSTRATIVE EXAMPLE: Projected Transactions per Hour | ||||

Day of Week | ||||

Monday -Saturday | Sunday | |||

Time of Day | Browser Banking | Mobile App | Browser Banking | Mobile App |

12AM-6AM | 1,000 | 2,500 | 700 | 850 |

6AM-7PM | 5,000 | 10,500 | 4,000 | 5,500 |

7PM-12AM | 3,400 | 9,000 | 400 | 350 |

Then, if the average value of a balance-changing transaction (ex. Transfer, Mobile Check Deposit) is, say, $1,500, we can roughly estimate the dollar value of all disrupted transactions per hour within those time periods.

ILLUSTRATIVE EXAMPLE: Transactions disrupted per event, dollar volumes | ||||

Platform or Product | Date | Duration | Transactions Disrupted | Approx. Value of Digital Transactions disrupted |

Online & Mobile | Sunday, 5/22 | 5hr @ 3AM | 5,800 | $2.7 million |

Online & Mobile | Thursday 6/19 | 4hr @ 6AM | 9,800 | $7.3 million |

Mobile Banking | Friday, 6/20 | 39min @1:45PM | 1,595 | $600,000 |

Most of those transaction dollars are not “lost”; they will simply be completed later, with some level of customer frustration.

But let’s consider mobile check deposits. If your bank’s app is unable to complete an attempted mobile deposit, that deposit will be delayed to a later date (best case), deferred to another channel such as ATM or teller (more costly for the bank), or deflected by the customer to a different FI’s mobile app (worst outcome for the bank). Understanding the hourly volume of mobile deposits during an app outage allows the bank to better estimate the costs of the outage (in deposit inflows).

And then there’s customer satisfaction and retention… At some point system availability issues begin to impact the lagging indicators of customer satisfaction, NPS, App Store ratings, and relationship retention. Disruptions that persist above a certain level will create headwinds to any CSAT improvement goals largely and will lead to attrition.

From now on, when you consider investments in improved platform availability, you have a better way to evaluate those costs.

Product and Channel Owners should be focused on platform availability:

- Aim for a level of platform disruption that does not impact customer satisfaction or attrition indicators. Consider both planned and unplanned. Add them up.

- Ensure diverse browser and device compatibility during QA testing.

- Reschedule planned maintenance whenever possible.

- Improve monitoring and alerting capabilities to reduce lag time between issue and response.

- Partner with Operations teams for visibility and management of processing times and dependencies that might result in inconvenience or delay for customers.

- Explore dependencies on third-party providers. Ensure SLAs are adequate, information exchange is timely, efficient, and meaningful.

Do you know how much money is flowing through your bank’s digital channel in the next hour?