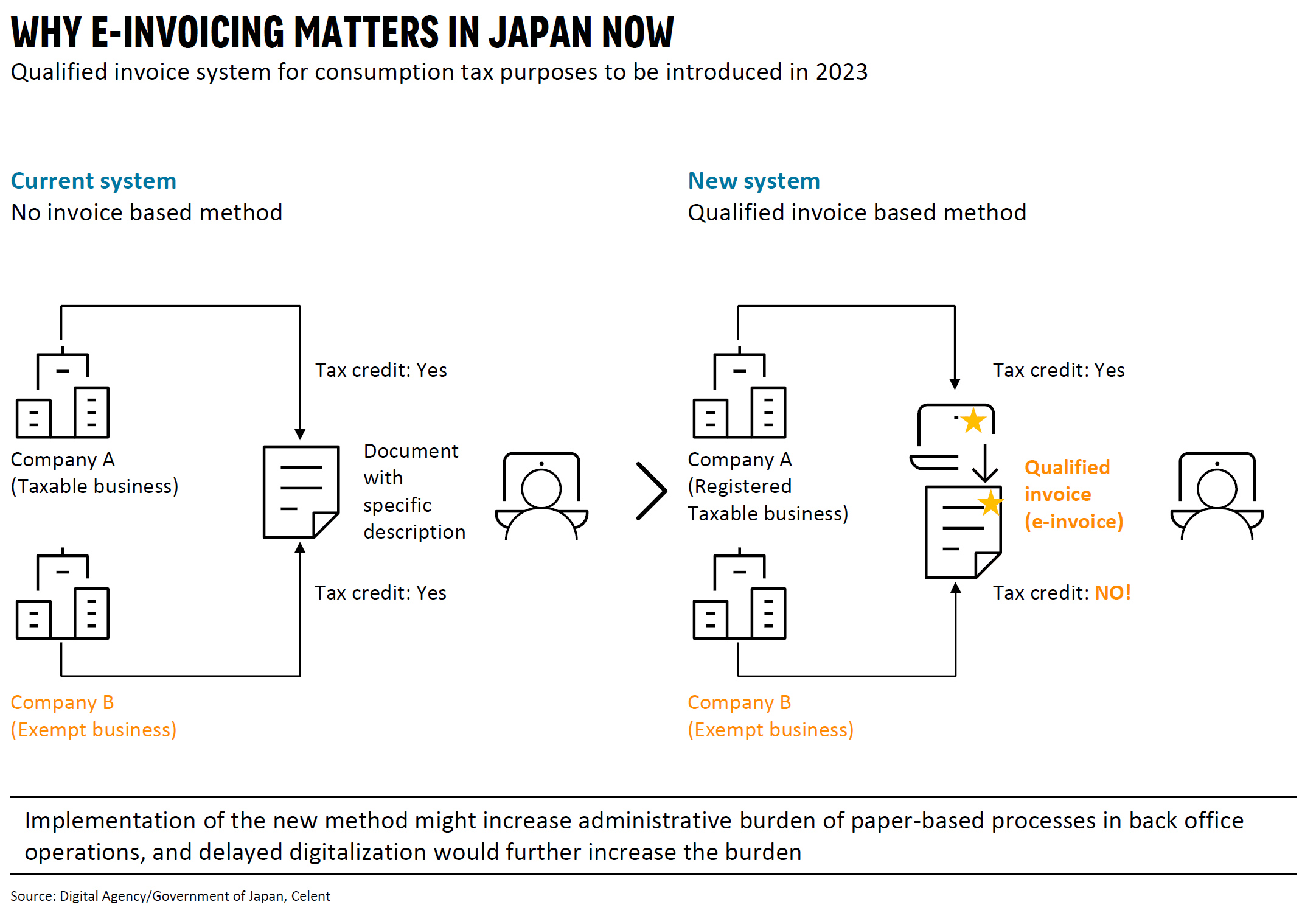

Electronic invoice (e-invoicing) is a system to digitize qualified invoices that are mandatory for the deduction of purchase tax under the qualified invoice system. This invoice system is intended to provide an appropriate consumption tax credit for purchases in response to the multiple tax rates for a consumption tax in 2019 and is scheduled to be introduced in October 2023. When the invoice system starts, only invoices issued by qualified invoicing businesses will be eligible for the purchase tax credit calculation. Invoices issued by others (e.g., tax-exempt businesses) will not be eligible for the purchase tax credit.

The handling of these qualified invoices is expected to create an unprecedented workload for both buyers and sellers, and presents an opportunity for innovation. The government and private sector organizations involved in accounting systems have begun discussions to introduce e-invoicing, or the complete digitization of invoices exchanged between companies, in preparation for the upcoming launch of the qualified invoice system.