Over the past five years, a few banks have mastered the formula for success in small loan origination. They are leveraging their incumbent advantage and reinventing the business, operating, and tech models. As a result, they are differentiating their offering, earning attractive returns, and gaining market share. For those who aspire to follow suit, the build/buy decision looms. The buy option has become increasingly attractive thanks to configurable cloud-based solutions with scale advantage in data and analytics.

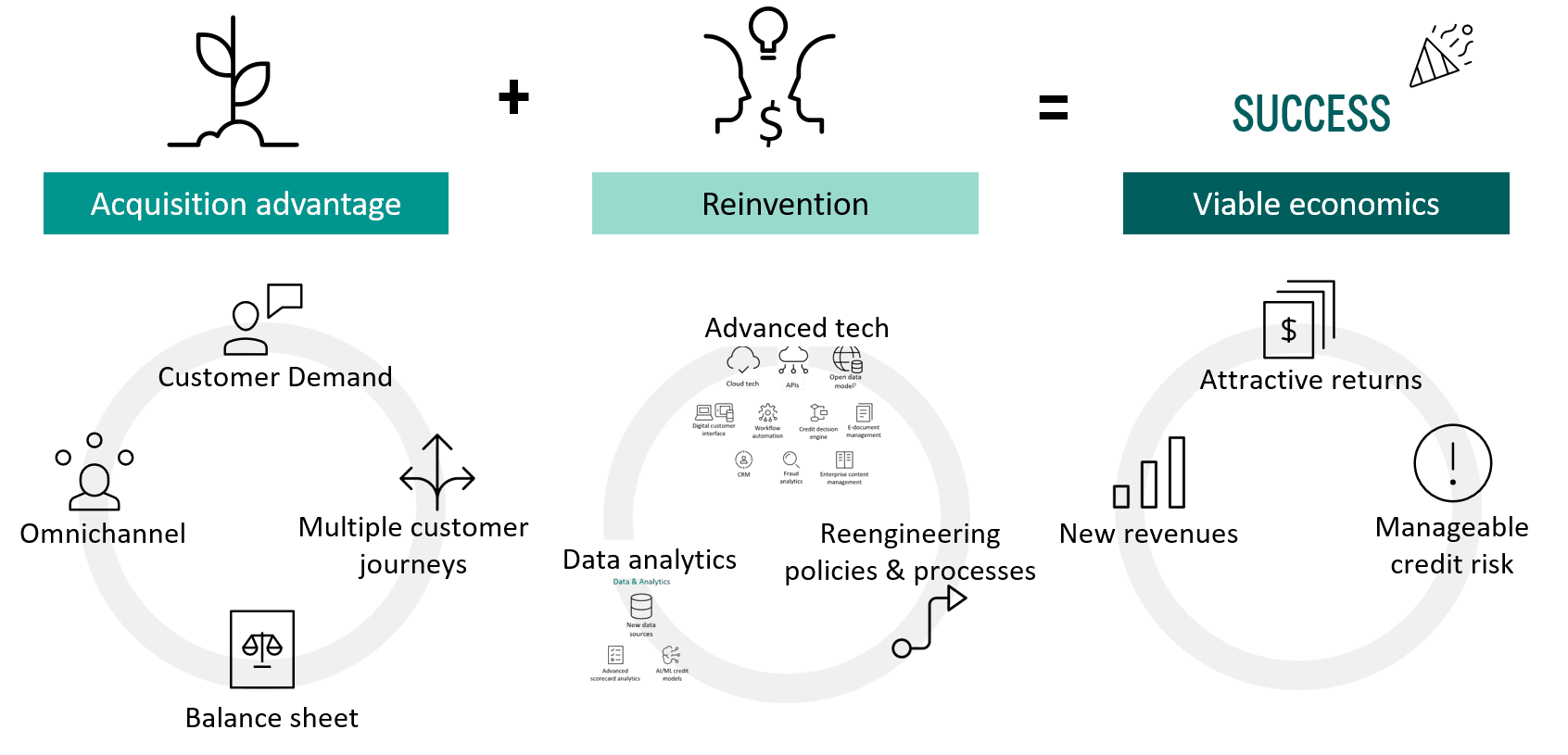

The formula for success boils down to the following: incumbent acquisition advantage plus reinvention equals viable economics (Figure 1). Banks bring a strong foundation for success that is often underestimated: customer demand, omnichannel, multiple customer journey capabilities, and a stable balance sheet. The factor they typically lack is digitalization across channels, products, and processes for both customers and employees. Without digitalization, the economics do not work.

Figure 1: Formula for Success

Some banks are finding that partnering with a tech vendor is the swiftest and lowest-risk path to success. Partnering goes beyond technology and its implementation to include advice regarding business and operating model reinvention. Banks must not pave the cow paths, that is, digitize the way their small business credit is run today. Rather, they must reengineer policies and processes.

To provide guidance to banks and credit unions seeking a tech partner, Celent has compiled this Solutionscape. Each of the tech vendors in this report offers a stand-alone, end-to-end digital loan origination platform that makes small loans (Note: Amount acquired LinearFT, which is the combination of Fundation and ODX).