By implementing Consent and Control Centres banks will strengthen the trusted customer relationships and lay the foundations for future engagement built on trust and fair value exchange.

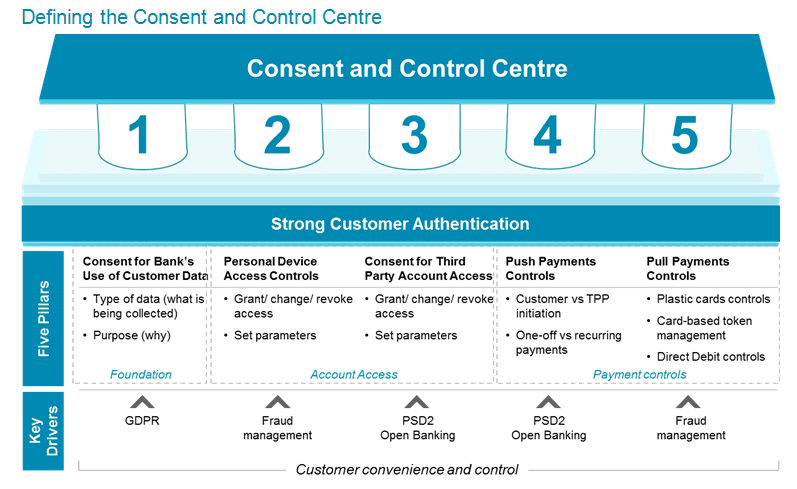

Banks should offer their customers control and self-service tools to manage their data via Consent and Control Centres (CCCs). The report defines the CCC, explains why it is important, and points to the players in the industry already taking steps in strengthening trust in their customer relationships.

As banking becomes more open, customers will be interacting with financial institutions not just through traditional and emerging banking channels, but also via third party providers. At the same time, individuals are becoming more aware of the value of their data, and are starting to become more conscious over what they share, with whom, and for what purpose.

We encourage banks to think beyond consent capture and storage, and to offer their customers control and self-service tools to manage their data on an ongoing basis. Banks that implement such Consent and Control Centres (CCCs) will strengthen the trusted relationships they have with their customers. Over time, the CCC can be expanded to nonbank data sources, leading to new monetisation opportunities, as well as reduced costs in data-intensive processes, such as Know Your Customer (KYC).