Crypto Custody

We have just published the first report which will be the basis for a new series exploring the potential to create new financial infrastructure and ecosystems of innovation with public blockchains.

Custody has been a key issue for crypto and digital assets as it crystallises issues related to risk, regulation, insurance, and fiduciary duty. Therefore, the emergence of new and specialised institutional-grade custody solutions of private keys represents a foundational piece of infrastructure upon which new partnerships and opportunities for incumbent financial institutions will emerge.

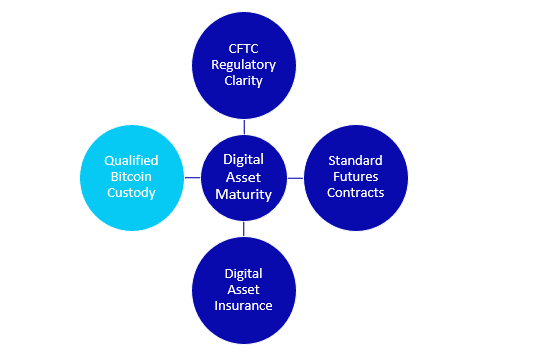

The Foundations for Digital Assets

Previously, we have highlighted that the four key foundations for crypto are now in place, specifically: CFTC regulatory clarity; standard Bitcoin futures contracts; third-party insurance; and qualified custodians.

Of these four elements, custody represents essential infrastructure which addresses the key custody challenges posed by digital bearer assets such as Bitcoin and which can accelerate institutionalisation of the asset class.

New Business Models and Revenue Opportunities

The unique attributes of crypto present specific challenges related to the custody of these assets. The ecosystem has been working exceptionally hard in recent years to address these challenges.

We are at an inflection point where incumbent financial institutions have an opportunity to pivot towards a crypto or digital asset strategy in a measured and controlled manner through new custody solutions which have flexible deployment models and offer highly customisable compliance protocols.

We anticipate material news flow regarding partnerships of incumbent financial institutions from Q2 2020 onwards as institutional-grade custody solutions bring trust to cryptocurrencies.

This presents a rare opportunity to capture new revenue and business models from a new asset class.