Digital technology enablement could augment alpha generation for active managers and stem the erosion against the tidal wave of passive investing.

This report explores a future-oriented view of how investment business priorities and risk dynamics in the buy side universe are expected to play out in the short-term to mid-term horizon based on recent Celent survey insights and data. The report also highlights their implications on investment and risk functions and technologies, and how firms should respond to these developments.

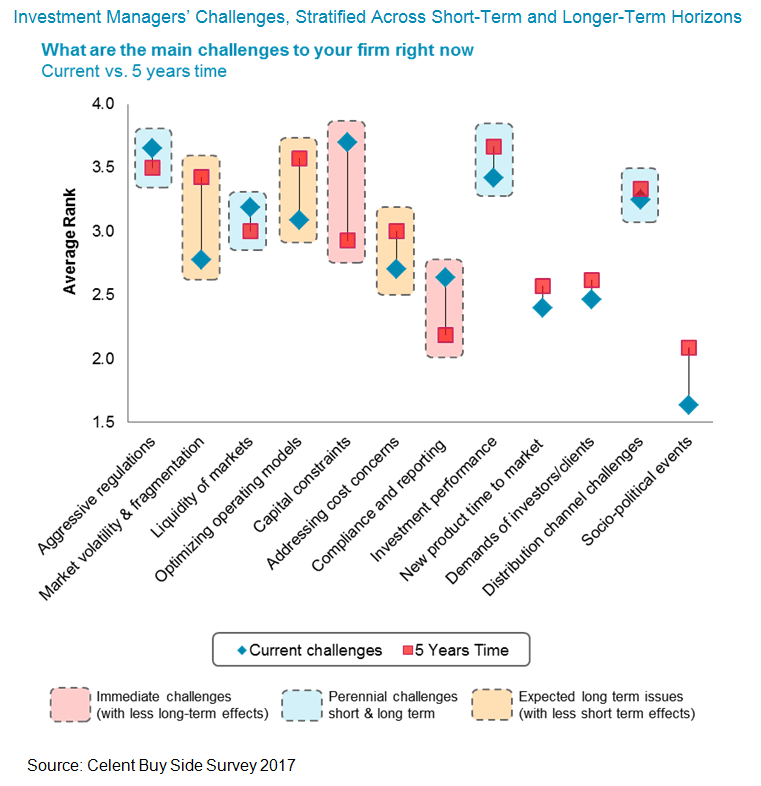

As active managers search for returns and value-added alpha within a dynamic market besieged by low interest rates, buy side firms face pressures from increased regulatory compliance and transparency requirements, structural market changes, the influx of digital technologies, and continual shifts in investor buying behaviour, product preferences, and performance/costs perceptions.

The market is undergoing another hype cycle. Investment firms are faced with an array of apparent opportunities to enhance and build next-generation investment and risk management capabilities. Buy side firms are naturally attempting to avoid as much regulatory costs as possible, but the big challenge over the next few years will be how to practically manage the cost of technology and to establish the right foundations for operational alpha to translate into value-added investment returns.