Amid COVID-19 panic and recovery, proxy season, and a US presidential election year, proxy voting is in the spotlight. These factors, along with growth of investment stewardship, create a near-term need to serve the investor as a voter. Investment stewardship is growing with significant investment from leading asset managers. This raises awareness around the institutions’ role in corporate decision-making and comes across the end investor’ mind as to how it affects their investments.

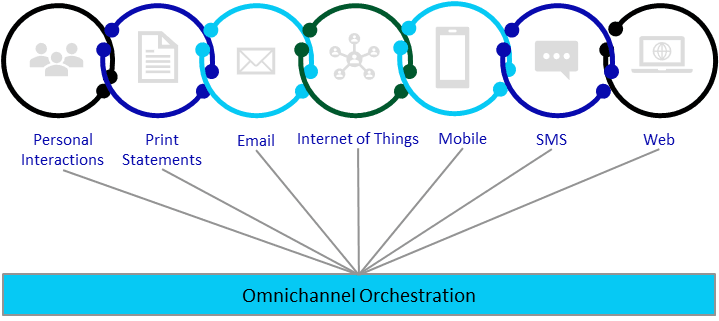

Wealth managers find proxy voting to be a requirement that bogs down operations and adds to the complexities and nuances of investor communications. For wealth managers responsible for either communicating the proxy information or voting on their client’s behalf, solutions are available to help. To streamline efficiencies, vendors provide solutions with omnichannel communication capabilities.

Starting with printing and mailing the proxy statement to using a digital platform — through APIs — to communicate via the web, mobile applications, or text message, core solutions enable a wide range of investor interactions. This report analyzes the growth of these digital channels and vendor’s innovative approaches to support them.