Celent explores the opportunities and challenges of the morphing sell side front office in this cross asset trading technology piece.

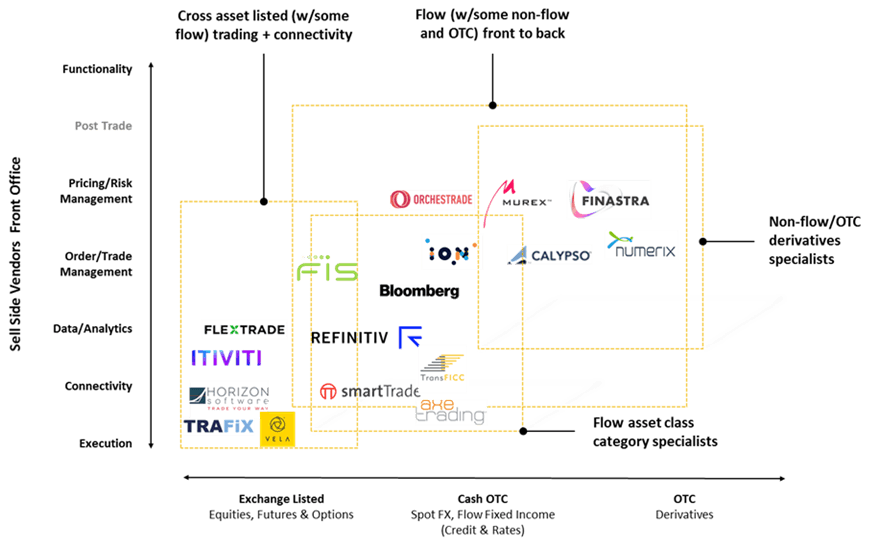

The advent of e-trading over the past decade led sell-side institutions to build electronic capabilities within asset class and product siloes. Various factors, including continued electronification and algorithmic trading across asset classes, sustained cost pressure on dealers driving the need for efficiency, and an evolution in the way large institutional investors are setting themselves up, are prompting dealers to become more coordinated and to leverage cross-asset technology solutions.

However, market structure differences between asset classes, siloed business lines within banks, and legacy technology stacks across products are inherent limits to the scale and pace of adoption of cross-asset technology. Net-net, we expect a gradual increase in the adoption of cross-asset trading technology in some asset classes and stages of the trade lifecycle on the sell side.

"The sell side is trying to better serve clients by automating interaction, tailoring offerings to specific client segments. Achieving this is hard when silos are extreme, and technology inadequate. The Covid crisis has highlighted existing sell side front office silo challenges , like: getting full 360 degree client views, pricing and quote automation, hedging ease, and risk management." Brad Bailey, Co-author