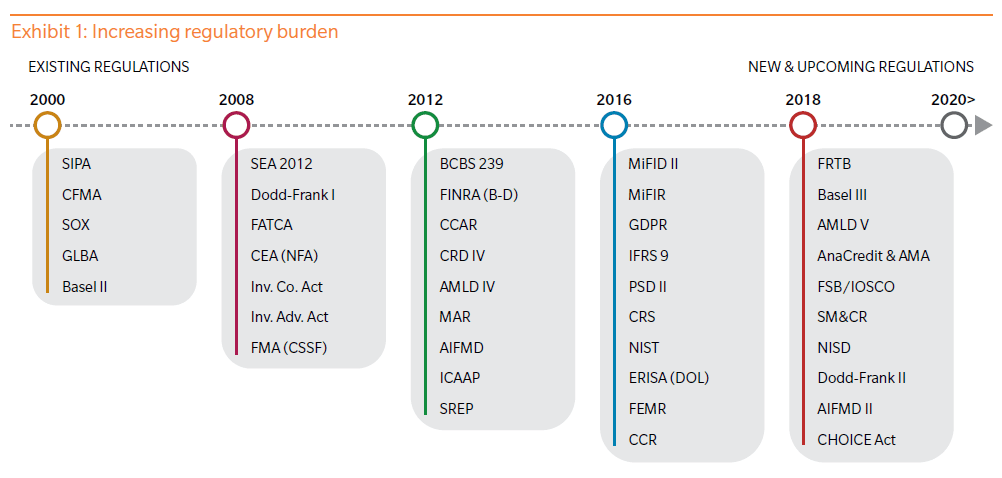

Financial services regulation has expanded at an astounding rate since the financial crisis — and, consequently, so has the cost of regulatory compliance. What was once a negligible expense has become a material component of firms’ annual spending.

Hence the emergence of RegTech. Over the past five years, hundreds of start-ups have begun to apply digital technology – including APIs, artificial intelligence (AI) and robotic process automations (RPAs) – to the now numerous and burdensome tasks required to comply with regulations. RegTech promises not only to cut the cost of compliance processes but also to improve effectiveness to make them quicker and more reliable, reducing hassle for customers, and lessening the risk of costly compliance failures. But the potential of RegTech extends beyond making compliance more efficient. The data and analytic techniques that satisfy regulators’ demands can also deliver commercially valuable insights about customers and markets. Used properly, RegTech can become a source of competitive advantage.