Rather than thinking of them as a single solution that fixes all problems, AI solutions should be viewed as a toolkit with different capabilities to solve specific pain points.

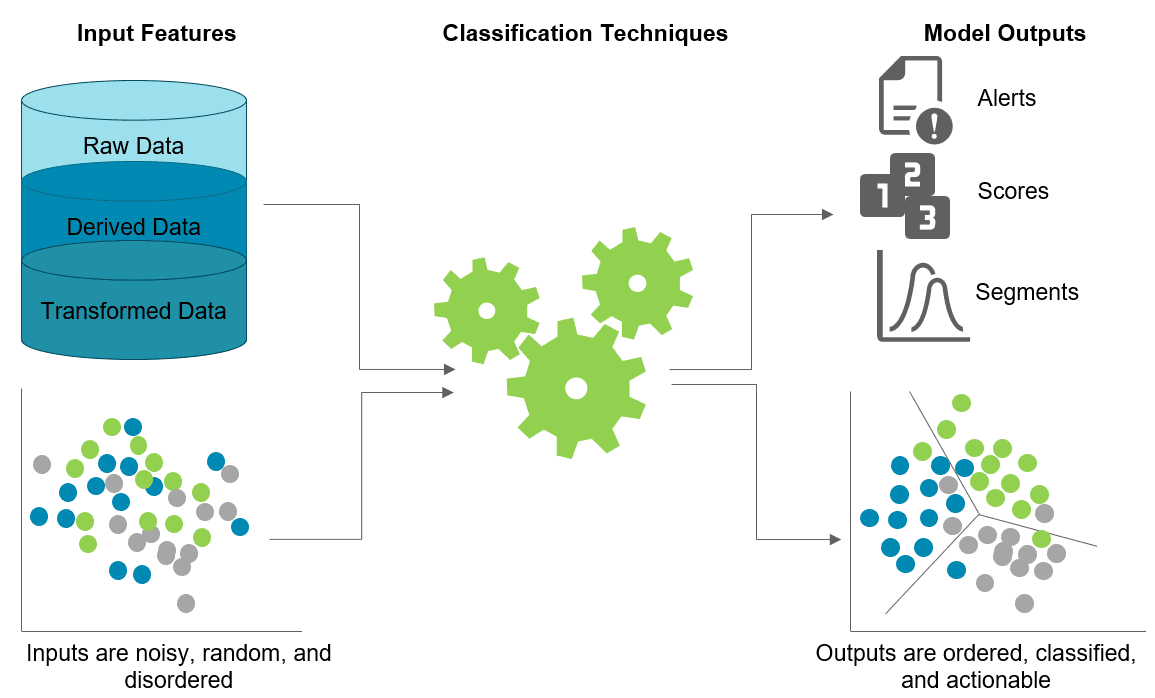

- Structured data analysis can be improved by several artificial intelligence (AI) techniques such as Linear Classification Techniques, Time Series, Principal Component Analysis, Cluster Analysis, Decision Trees, Neural Networks, and many others.

- These can be applied in model exploration, model tuning, segmentation, pattern analysis, anomaly detection, predictive scoring, and scenario authoring.

- Unstructured data analysis can be vastly improved by leveraging automation and advanced analytical tools such as Optical Character Recognition, Robotic Process Automation, and Natural Language Processing.

- These can be applied in media analysis, automated investigation, reporting, and suspicious activity report filing.

- Sophisticated visualization tools such as ROC Curve, Graph Analytics, and Interactive Drill Down can be applied in KYC-AML.

- These visualization techniques aid model exploration, pattern discovery, and investigation efficiency.

Adoption of process automation and advanced analytical tools can bring in enormous benefits. Their successful adoption adoption will rely on operational flexibility to handle data, infrastructure, workflow, and resource management capabilities.

Features and Classification Techniques Determine the Performance of AML Programs