Strategies for Enhancing Corporate Client Experience: The Future of Attended Channels

Abstract

Celent has released a new report titled Strategies for Enhancing Corporate Client Experience: The Future of Attended Channels. The report was written by Susan Feinberg, a Senior Analyst with Celent’s Banking practice.

Surveys of corporate clients indicate that banks have a lot more work to do to satisfy the demands of end users who want their corporate banking applications to be as easy to use and as convenient as the applications they use as consumers.

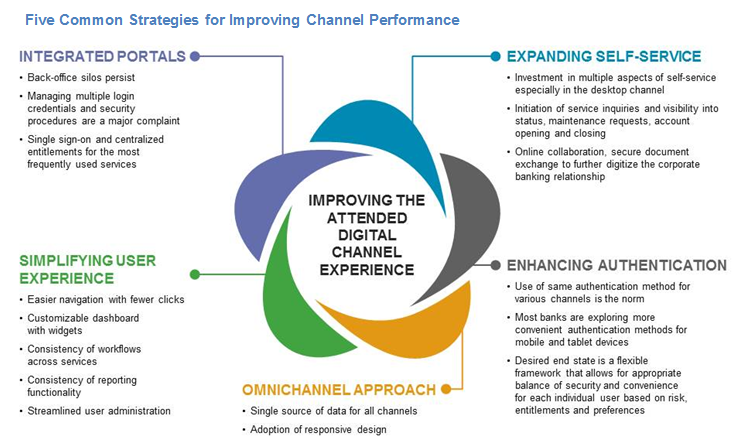

Attended channels remain the daily face of the bank to a large percentage of clients, regardless of how many other channels are being used. Simplifying, unifying client interactions across business silos, and delivering on the promise of convenience in a secure manner are the key strategies. The opportunities to differentiate include creating a customized and tailored user experience, enriching data, offering access to new payment services, integrating attended and unattended channels, and delivering a coherent strategy for supporting the emerging needs of small business clients for cash management services.

“In the current environment, attempting to implement a successful strategy for digital channels in the absence of an overall digital transformation strategy for corporate banking is short-sighted,” Feinberg commented.

“The decisions being made today about attended digital channels — whether as a part of a larger digital transformation initiative, in enhancing the channel user experience, or establishing a corporate banking portal — will have a significant impact on the ability of corporate banks to attract and retain clients,” she added.