Making Good Decisions in Bad Times: Helping Treasurers to Effectively Manage Liquidity

Abstract

Managing liquidity during COVID-19 has become both challenging and critical for businesses. The pandemic has exposed important gaps in the frameworks, analytic tools, and processes by which companies make decisions in crisis regarding liquidity. Decisions that are rapidly made today frequently suffer from a lack of robust underlying information, insufficient consideration of trade-offs and implications for the broader ecosystem (for example, suppliers), and lack of clear oversight. This challenge is exacerbated in times of crisis, where decision making needs to be well-informed and quick to avert financial distress and unintended consequences.

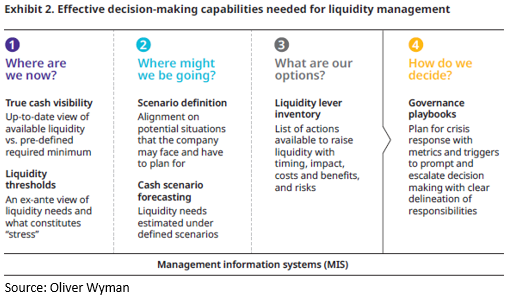

The latest report from Oliver Wyman, "Making Good Decisions in Bad Times: Critical Capabilities for Effective Liquidity Management," lays out four central questions that companies need to effectively develop their capabilities to answer in order to make good decisions consistently over time:

There is an opportunity for banks to help their corporate customers to prepare for the next crisis, partnering to create capabilities to bolster resilience and profitability for years to come. According to Oliver Wyman, here is a rundown of critical gaps that need be closed:

- True cash visibility: A consistent, realistic, up-to-date view of the liquidity available to the company

- Liquidity thresholds: An ex-ante view of the liquidity needs of the company, and what constitutes “stress”

- Scenario definition A realistic suite of scenarios outlining a likely future state of the world, across a range of possible severities

- Cash scenario forecasting A robust methodology to forecast cashflows associated with those scenarios

- Liquidity lever inventory Comprehensive view of actions available to raise liquidity with timing, benefits, costs, and risks

- Governance playbooks Plan for crisis response with metrics and triggers to prompt decision making and the clear delineation of responsibilities

Want to learn more? Check out the full report.