Comparing Channel Priorities: Europe and the US

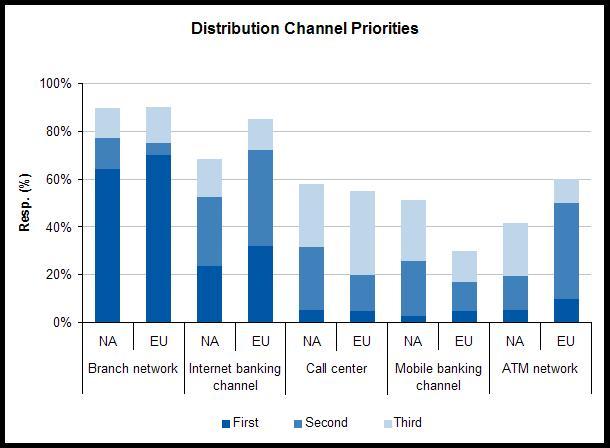

[/caption] I’d like to offer a few observations and invite your comments. In both regions: • Multichannel investment is a high priority • Branch channel remains the highest priority, closely followed by the internet channel. Interestingly, branch channel priorities are nearly identical across the two regions. • Mobile banking is the lowest priority channel However, there are several significant differences. Specifically: • The ATM channel is a much higher priority among large European banks than it is among the US sample. 50% of the EU banks rated the ATM channel #1 or #2 in priority compared to just 19% among large US banks. • The mobile channel is a comparatively low priority among EU banks (17% placing mobile banking among the top-2 priorities versus 26% among large US banks). Now, two questions for our readers. Feel free to post a comment or e-mail me directly at bmeara@celent.com if you wish to weigh in off the record. 1. Why is the ATM channel such a comparatively high priority among EU banks? 2. Conversely, why is the mobile banking channel such a comparatively low priority? I’ll post a summary of responses along with a Celent/Oliver Wyman position next week.

[/caption] I’d like to offer a few observations and invite your comments. In both regions: • Multichannel investment is a high priority • Branch channel remains the highest priority, closely followed by the internet channel. Interestingly, branch channel priorities are nearly identical across the two regions. • Mobile banking is the lowest priority channel However, there are several significant differences. Specifically: • The ATM channel is a much higher priority among large European banks than it is among the US sample. 50% of the EU banks rated the ATM channel #1 or #2 in priority compared to just 19% among large US banks. • The mobile channel is a comparatively low priority among EU banks (17% placing mobile banking among the top-2 priorities versus 26% among large US banks). Now, two questions for our readers. Feel free to post a comment or e-mail me directly at bmeara@celent.com if you wish to weigh in off the record. 1. Why is the ATM channel such a comparatively high priority among EU banks? 2. Conversely, why is the mobile banking channel such a comparatively low priority? I’ll post a summary of responses along with a Celent/Oliver Wyman position next week.コメント

-

Hi Bob,

My conversations with clients mean I concur with Tim. With mobile in particular, some countries have had a form of mobile banking for 15+ years. We're in reality we're at different points on the "hype cycle" as we're now seeing something of a pushback in Europe.However, I would also note that many European banks would consider smartphones as internet banking, not mobile. This tallies with the statement Tim makes as they also see the ATM as increasingly a kiosk (ie internet channel) with a cash facility. Note that the banks in Europe have had to invest in ATMs for regulatory reasons, so that will have skewed the results.

This also tallies to the branch - they've switched back from the old move of separating out transactional interaction to low cost channels (ie ATMs, online), to thinking those transactions actually should be built on and so they are trying to create as much opportunity to interact with the customer at as many places as possible. Anti-disintermediation!

Cheers

Gareth

-

Bob,

The conclusions are correct, in that there is a critical lack of understanding of the game changing nature of mobile (and social media) in the banking arena. The lack of investment in real mobile engagement for banks is a reason why over the next 2-3 years a whole slew of non-bank competitors are going to start to enter the fray and take share of wallet from banks.

My post last week covers off the growing infrastructure and behavior gaps that are emerging as a result of the generational management gap in the big banks today.

http://www.banking4tomorrow.com/2010/12/what-the-finance-sector-has-to-look-forward-to-in-2011/I just think that unfortunately this research is suffering a little from the same. To exclude 'Mobile Payments' and 'Social Media' as separate channel priorities is indicative of the discussions and questions being asked in the sector. We just aren't going far enough in challenging existing strategy in the banking arena.

Regards,

Brett King

Author - BANK 2.0 -

Thanks all for your thoughts!

A risk in short blogs (versus long reports) is that of missing relevant context. The research cited above was indeed branch centric. Purposefully so. A number of financial institutions are struggling to evolve their branch channels in the face of increasing self-service channel usage and resulting declines in foot traffic. The situation preasnts huge challenges to FIs worthy of research. So in that context, the survey's treatment of mobile payments and social media was light.

That said, when did social media become a delivery channel for financial services? Social media is undeliably important. Equally undeniable is the notion that financial institutions are behind the curve. But isn't social media a means of communications best considered in the context of the several delivery channels in which it plays a part: internet, mobile, call center?

Hi Bob,

I'd submit the following hypothesis as to why we are seeing differences:

1. In the US, the ATM channel has really only seen additional capabilties for check deposits or envelope free ATM's, this was important due to the check volumes, check 21 and to move this to self-service. However in Europe, its seen as a channel that can provide new Self-Service capabilities not just for additional financial transactions , but as an on-ramp for customer servicing and of course selling, for example we are already seeing deployments of Video Kiosks, so this channel is morphing into a multi-functional and media Self-Service Kiosk.

2. On mobile, Europe has always been more advanced in it's telecomunnication networks and services, particularly in places like the Nordic region, in addition, electronic banking and payments has long been the norm. European Institutions have already deployed Mobile Banking applications for many years. In contrast, the US has a laggard in Mobile communications and services, so the US Banks have only recently started to deploy the first generation of mobile banking applications, one of the innovations of course being RDC for checks.

best regards

Tim