Health Insurance Research Outlook 2024

2024 RESEARCH THEMES

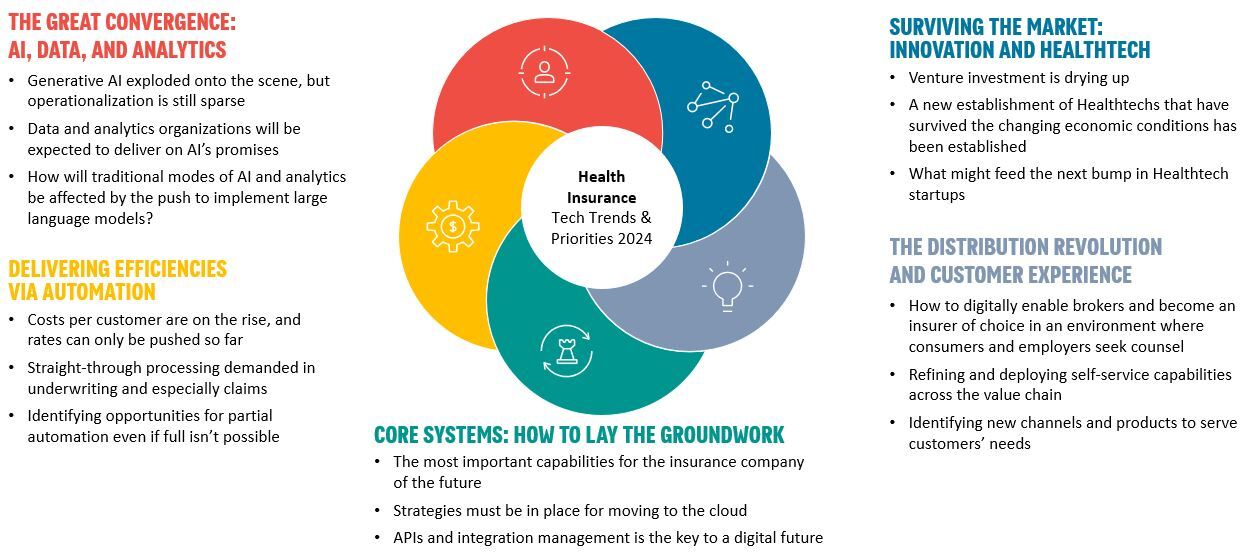

Leading into 2023, we viewed the industry from the lens of a post-pandemic world at the edge of economic meltdown. Our review focused on how to shake up health insurance, as the industry overall looked to move on. As we move into 2024, the impact of the pandemic is mostly in the past, but economic pressures remain. The market is also struggling with a recurring issue of complacency on the part of the buyer.

As we move further into 2024 the two big stories for health insurers are the rising cost of care and Generative AI. (You knew we couldn’t go even one sentence without mentioning Gen AI). The cost of care and the shortages of nurses have had a major impact on the industry. However, the downstream effects of central bank rate increases on the startup funding economy changed the healthtech landscape overnight, demanding tighter, demonstrable return on investment (ROI) from innovations. On the horizon this year: Rate stabilization will hopefully allow insurers to plan rather than react.

Costs still remain a major risk of the health insurers. Costs are increasing at an exponential rate. In the US in particular, the cost of care has outstripped the ability for insurers to pay. Many states have not expanded Medicaid. Rural hospitals are failing and reducing services. Overall, healthcare in the U.S. is struggling.

There is one new macroeconomic factor that we will cover at length, and that is generative AI (GenAI). It is more than just a technology story. If adopted at massive scale, GenAI will wholly disrupt employment markets while fundamentally changing the relationship between people and firms and the world they inhabit. It is perhaps only comparable to the launch of the internet itself, and certainly the most impactful technology since the smartphone achieved critical mass. The explosion of interest in Generative AI has created a wide variety of use cases that insurers can investigate – all while requiring governance frameworks to manage the risk of this untested technology.

And with advancements in healthcare and increased life expectancy, insurers are facing challenges related to longevity risk. Health insurers are looking to develop sustainable strategies to manage risks associated with longer lifespans.

Top priorities such as customer experience, acquisition, retention, and loyalty will continue to be a high priority as insurers look for ways to use technology to differentiate and focus on the continuous evolution of the digital experience. The technology used will vary, but will be focused on data, analytics, digital, artificial intelligence, and more, to continue to transform the customer experience and meet ever increasing customer expectations.

Innovation and continuous technology transformation are other areas insurers must stay acutely focused on to keep pace and differentiate themselves from the competition and to protect margins.

The areas of research that we’re working on for this quarter are critical areas that we suggest insurers consider to optimize the value of their technology investments.

Contact us for more information about what we have planned in Q2.

If you are a client, please sign in to access a detailed view of our 2024 agenda.