Meeting the Fintech Challenge in Digital Consumer Lending: Strategies and Technologies for Innovation

Depository-based lenders must leverage their business acumen and build new technology to compete.

Key research questions

- How have new technologies and fintechs made lending digital?

- How will digital lending better satisfy and attract more customers?

- How must banks transform lending to improve business performance?

Abstract

Digital lending is not limited to fintechs; banks and credit unions have many strengths which, when combined with digital technology, will enable them to thrive long after the Fintech Era ends.

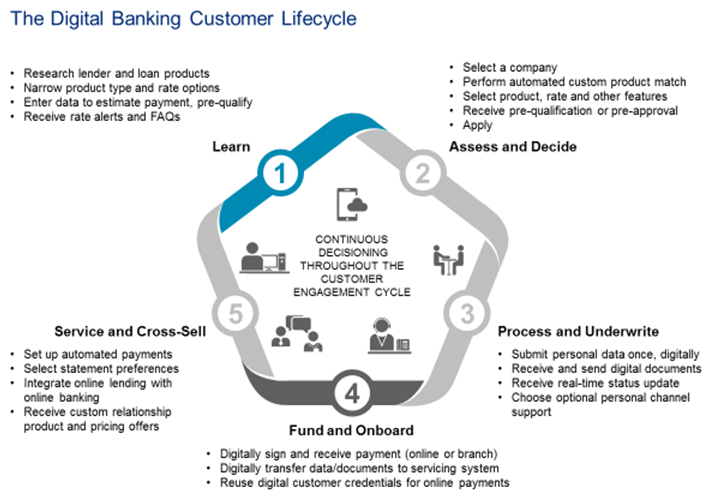

Fintech startups didn’t invent retail lending, and their long-term success is still in question, but their digital innovation is pressuring depository-based lenders to ask: What is the fintech lending threat, and how do I respond? What new digital lending technologies do I need to compete? How will digital lending transform my customer engagement, processes, and performance?

Fueled by venture capital and the latest technology, startups are building new lending platforms and delivering digital lending services to customers using new business models. This has forced established, regulated depository institutions to reexamine their strategies and technologies. Yet digital lending is not one technology; rather it is created by combining multiple technologies across the credit lifecycle, from mobile customer interfaces to digital documents, scoring, decisioning, electronic signature, workflow, compliance and cloud-based technology. Moreover, these technologies need to be combined in different ways for different types of loans: automobile, credit card, home equity, mortgage, and personal loans.