The Big Shift: How Infosys BPM Can Help Clients Prepare For The LIBOR Transition

Abstract

The clock is ticking for financial institutions (FIs) to adequately prepare for the seismic shift from the London Interbank Offered Rate (LIBOR) to Alternative Risk-Free Rates (AFRs). Some have called the departure from the globally accepted benchmark rate that touches over $350 trillion in transactions, “ ... one of the biggest financial engineering jobs in history.” Others, such as Senior Advisor of the Federal Reserve David Bowman, have described the event as “ ... tantamount to a couple of Y2Ks.”

While, understandably, many FIs are presently devoting the bulk of their resources to managing the risks associated with COVID-19, it is imperative they also address the potentially significant challenges created by the transition. Despite the uncertainties caused by COVID-19, the Financial Conduct Authority (FCA), who oversees LIBOR, reaffirmed its commitment to eliminate the key benchmark by the end of 2021 despite other calls for relief given the current crisis

The LIBOR transition poses many financial, legal, operational, and technological vulnerabilities. It will require FIs to comprehensively identify their aggregate risk and exposure. They will need to determine the impact, risk, and remediation requirement across their business, operating model, and transaction portfolio. In order to make a seamless transition, FIs must devote substantial resources toward amending contracts, rearchitecting legacy systems, and educating their employees on AFRs. Banking, capital markets, commercial lending, trading, and treasury are some of the businesses that are most likely to be affected.

There are a host of firms playing in this space, and we thought Infosys’ approach would be helpful for financial institutions thinking about how to handle the transition. The breadth of solutions is well thought out and offers a useful roadmap for firms as they consider how to address the LIBOR transition. Infosys, in partnership with Edgeverve, SoluxR, and Stratagem Partners, has developed LIBOR transition service to help FIs navigate the shift to AFRs. Known as Infosys BPM’s LIBOR Transition Services, the offering employs a technology driven approach that utilizes best practices and assists workflows.

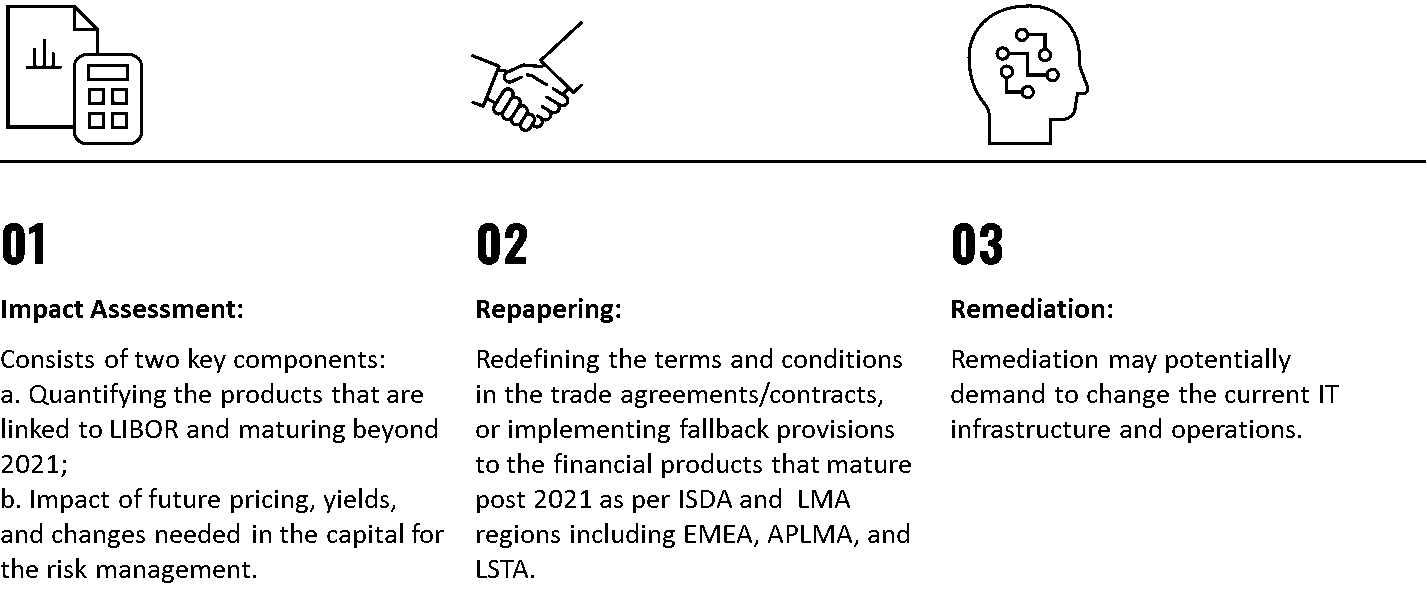

The offering is a modular solution of partners which provides support throughout three key phases of the LIBOR transition process: impact assessment, repapering, and remediation.