Embarking on a Journey from “Surveillance” to “Detection”

REPORT PREVIOUSLY PUBLISHED BY OLIVER WYMAN

Abstract

Inappropriate conduct has cost the financial services industry a significant amount in direct losses, lawsuits, and fines since the last financial crisis. In response, banks have invested heavily in surveillance programs to identify employee misconduct manifesting via trading activity and electronic and voice communications.

These programs are typically relatively simplistic and rules-based, and have often expanded over time to form a complex and inefficient web of firm-built and vendor solutions. While a radical transformation of existing surveillance programs would be quite difficult in the current environment, it is essential that financial institutions seriously consider and plan for what comes next, as it is clear that the status quo will not hold.

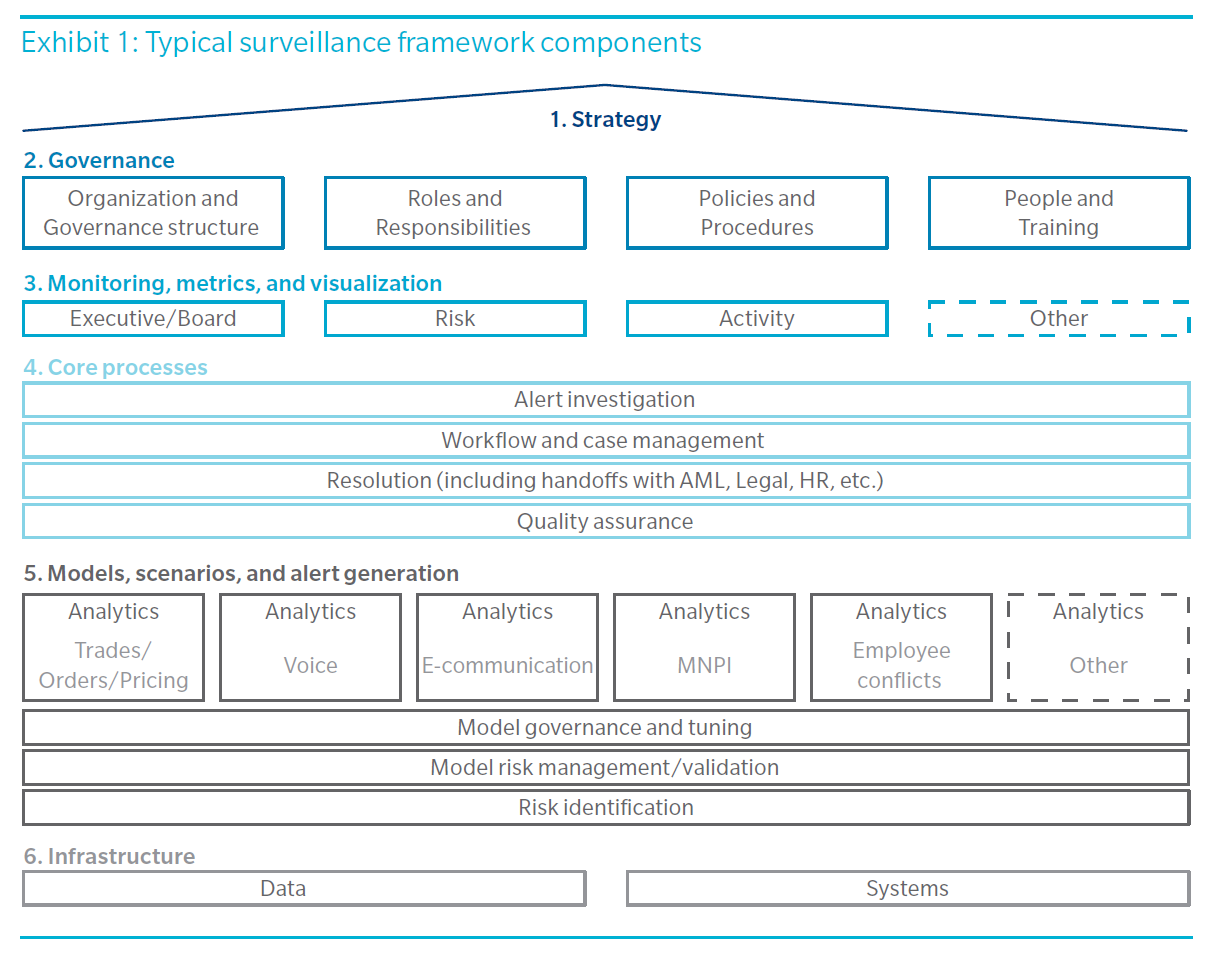

Many financial institutions face challenges across components of their capital markets-related surveillance frameworks, including current rules-based alert generation, lack of robust metrics, inefficient core processes, as well as suboptimal underlying infrastructure. Oliver Wyman recommends a strategic transition from the current rules-based approach towards a more dynamic, integrated, and conduct-oriented detection process. This strategy should be broader than selecting among new vendors, it should include investment in the human and technological capacity to enable financial institutions to more dynamically respond to emerging risks and more effectively and efficiently identify misconduct.