#EmotiveBanking

7 December 2014

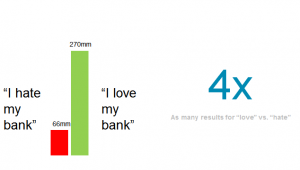

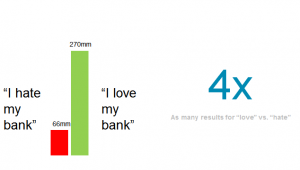

Dan Latimore

I’ve just returned from my last conference of the year, the excellent and intimate NetFinance Interactive held in rainy (sic) San Diego. I’ve been talking about the importance of emotions, feelings and the ineffable in banking for the last two years, and this conference was the first time that this theme has been widespread among presenters and in conversation. Perhaps the tide is finally turning. Why is this important? Money and finances are an intimate and emotionally fraught topic, like health. Do you prefer a doctor who clinical and dispassionate, or one who’s sympathetic and caring? Now just apply that to your banker. Back in June I compared googled “I love my bank” and “I hate my bank.” My hypothesis was that the hate would blow love out of the water. I was spectacularly wrong:  As of December 6, it’s changed a bit; 110mm haters to 318mm lovers, or a ratio of 2.9x. But why is this? It seems so counterintuitive. My new hypothesis is something of a good news / bad news scenario for banks: customer expectations are so low that when they’re positively surprised on the upside, they’re so flabbergasted that they just *have* to tell someone about it. The lesson for banks? Look for opportunities to surprise your customers. Great service when they least expect it will get you noticed and deepen customer loyalty.

As of December 6, it’s changed a bit; 110mm haters to 318mm lovers, or a ratio of 2.9x. But why is this? It seems so counterintuitive. My new hypothesis is something of a good news / bad news scenario for banks: customer expectations are so low that when they’re positively surprised on the upside, they’re so flabbergasted that they just *have* to tell someone about it. The lesson for banks? Look for opportunities to surprise your customers. Great service when they least expect it will get you noticed and deepen customer loyalty.

As of December 6, it’s changed a bit; 110mm haters to 318mm lovers, or a ratio of 2.9x. But why is this? It seems so counterintuitive. My new hypothesis is something of a good news / bad news scenario for banks: customer expectations are so low that when they’re positively surprised on the upside, they’re so flabbergasted that they just *have* to tell someone about it. The lesson for banks? Look for opportunities to surprise your customers. Great service when they least expect it will get you noticed and deepen customer loyalty.

As of December 6, it’s changed a bit; 110mm haters to 318mm lovers, or a ratio of 2.9x. But why is this? It seems so counterintuitive. My new hypothesis is something of a good news / bad news scenario for banks: customer expectations are so low that when they’re positively surprised on the upside, they’re so flabbergasted that they just *have* to tell someone about it. The lesson for banks? Look for opportunities to surprise your customers. Great service when they least expect it will get you noticed and deepen customer loyalty.