銀行における個人情報の取り扱い: 顧客の同意

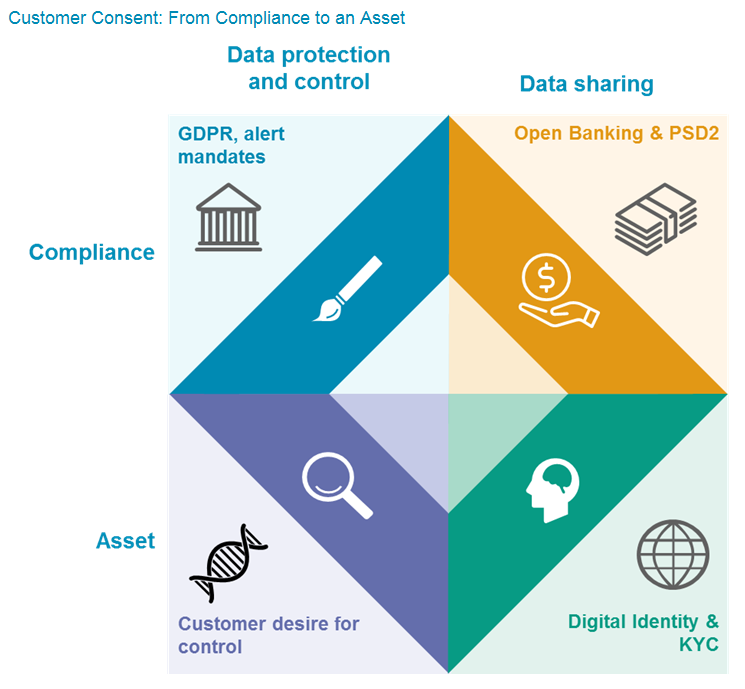

Customer Consent: From Compliance to an Asset

Abstract

Turning customer consent into an asset for banks.

Managing customer consent for data usage and data sharing is rapidly becoming a critical skill for banks. Banks can choose to treat the requirement for customer consent as a compliance effort, or can turn it into an important asset going forward.

Regulatory and consumer attitudes to data protection, controls, and data sharing are undergoing important changes in many markets around the world, and especially in Europe. Managing customer consent for data usage and data sharing is rapidly becoming a critical skill for banks. Banks can choose to treat the requirement for customer consent as a compliance effort, or can turn it into an important asset going forward. Taking a strategic approach to data will help banks strengthen the trusted bond with customers and open future opportunities. This Flash Insight describes some of the key changes happening in the marketplace around customer data, and shows how banks can gain a crucial new asset that will give them competitive advantage.