Around the world, the financial services industry is undergoing a profound generational change which presents tremendous opportunities for innovation. One of the most fundamental shifts, and the one that requires the biggest shift in mindset, is harnessing the power of the innovation ecosystem. The innovation ecosystem offers a host of opportunities for firms willing to adopt the behaviors necessary to succeed in this new environment including:

- Partnering with third parties to maximize value

- Seizing opportunities enabled by new, cutting edge technologies

- Cooperating with new entrants

- Reinventing the customer experience in the context of this ecosystem.

At this year’s Innovation and Insight Day, attendees heard firsthand accounts of firms who have achieved success within this new ecosystem and learned how they can emulate their success within their organizations.

The event also served as a showcase for the winners of Celent's annual Model Bank Awards, Model Insurer Awards, Model Wealth Manager Awards, and Model Risk Manager Awards.

Sponsors

Celent would like to thank the following companies for their support of this conference:

Premium sponsors

Sponsor

Select sponsorship opportunities are under development for 2020. For more information, please contact Elizabeth Durney at edurney@celent.com.

Feedback

Please take a moment to complete our follow-up surveys. Your feedback will help us improve future events.

Presentations

Sign in and click on the links below to download the presentations.

Photos

-

Celent’s CEO Jamie Macgregor and Head of Retail Banking Dan Latimore kicked off the day discussing insights from our research that highlight the latest industry trends. -

This year we recognized 23 financial institutions and their initiatives with Model Bank 2019 awards. -

We awarded 20 insurers for their initiatives in Digital & Omnichannel, Legacy & Ecosystem Transformation, Innovation and Emerging Technology, Operational Excellence, and Data, Analytics, and Artificial Intelligence. -

Dan Latimore, Head of Retail Banking, started off the Banking sessions with an overview of the day on how the theoretical gets implemented into successful innovations. -

This year we celebrated 20 years since Celent was formed in 1999. -

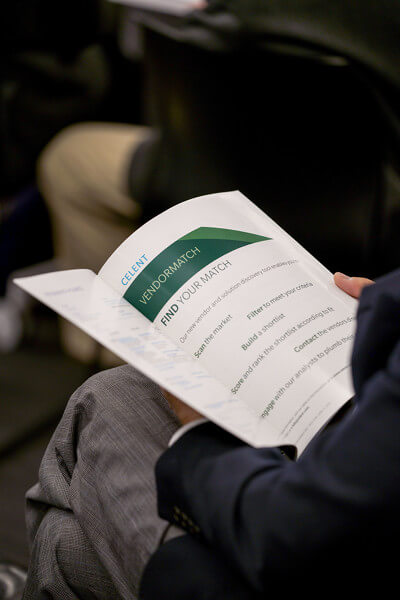

Our attendees learned more about Celent's VendorMatch. A tool that enables users to quickly scope the market for financial technology that meets their requirements. -

Keynote speaker Greg Baxter of MetLife delved into the role and ethics of AI in digital transformation. -

Karlyn Carnahan, Head of Americas, Property & Casualty, presented AIA Group the 2019 Model Insurer of the Year Award. -

Attendees forged connections over the shared experience of the day. -

Sponsor Tony Krell of CenturyLink engaged with Model Bank Winner Derek Vernon. -

Keynote speaker Greg Baxter continued the discussion with a number of attendees. -

Senior Analyst Zil Bareisis kicked off the Model Bank Awards with an overview of this year’s entries. -

Travis North, Vice President of Argo Group, spoke about the next generation of digital experience. -

Senior Analyst Stephen Greer presented the award for Best Digital Bank to Bancolombia. -

Model Wealth Manager Awards Panel with Carlos Alonso, Deusche Bank Spain’, Raj Madan, BNY Mellon's Perishing, and Vinod Ramen, Fidelity. -

Senior Analyst Joan McGowan discussed Risk Management and Process Automation in Banking. -

Senior Analyst John Barr explored the winning initiatives for Legacy and Ecosystem Transformation in Insurance. -

Celent’s Tom Scales led a panel on ‘The Ecosystem Unleashed’. -

David Easthope moderated a panel discussion featuring the winners of this year’s Model Asset Manager Awards. -

Sponsor Lakshan De Silva, CTO at got things started for this year’s debate on ‘The Future of Voice’. -

Celent’s Alenka Grealish stated her case for what the future of voice holds for the industry.

Program

Download the onsite program- 8:30 a.m. Networking Breakfast

-

9:30 a.m.

Welcome and Opening Comments

Jamie Macgregor, CEO, Celent; Dan Latimore, Head, Retail Banking, Celent

Jamie and Dan provided insights from our research that highlighted the latest industry trends with a focus on how they are evolving through the increased uptake of digital, data, and AI.

-

10:15 a.m.

Keynote Address — The Next Industrial Revolution — Doing Good with Technology

Greg Baxter, Chief Digital Officer, MetLife

Digital is revolutionizing every industry, and each of us has a role to play in shaping that revolution — ethically and responsibly. Today, companies — with an unimaginable wealth of data available — have the opportunity to move from protection to prediction and prevention. Greg discussed how firms are investing in frontier technologies focused on making people’s lives better and how they are thinking about leveraging that technology to effectively change the industry—and the world.

- 11:00 a.m. Networking Break

-

11:30 a.m.

Breakout Sessions

Attendees had the chance to get up close and personal with the individuals and firms that are transforming the banking, insurance, wealth and asset management industries. They heard firsthand accounts of organizations that are finding ways to turn the theoretical into the practical by implementing successful innovations.

These highly interactive sessions also offered a variety of perspectives from firms that have not only found success with their initiatives but also found ways to take advantage of new models of innovation within their organizations.

-

-

11:30 a.m.

Welcoming Remarks and Model Insurer 2019 Overview

Karlyn Carnahan. Head, P/C, Insurance

We kicked off with an overview of the overarching trends driving the digital transformation agenda in insurance today. Attendees heard an overview of the Model Insurer program in 2019, the number of nominations, their geographic spread and where we see the most innovation.

- Model Insurer of the Year

-

Featured Speaker: Enabling Argo’s Systems to Support the Next Generation Digital Experience

Travis North, Vice President, Group Architecture and Innovation, Argo Group

In a world of customer-centric design, there is a new way of looking at the customer experience — and delivering on that experience requires a wide variety of digital capabilities that aren’t typically found in old legacy systems. Travis told the story of how he is enabling Argo’s systems to support their next generation digital experience.

-

Model Insurer Awards Presentation: Innovation and Emerging Technologies, Legacy and Ecosystem Transformation

We learned about this year’s winning initiatives as Celent analysts discussed the innovations that inspired them.

Mike Fitzgerald, Senior Analyst — Innovation and Emerging Technologies

John Barr, Senior Analyst — Legacy and Ecosystem Transformation

-

The Ecosystem Unleashed

Moderator: Tom Scales, Head, Life and Health Insurance Americas, USA

- 1:00 pm Networking Luncheon

- 2:00 pm Platforms/API and Ecosystem Evolution Donald Light, Director, P/C Insurance

-

Model Insurer Awards Presentation: Operational Excellence, Digital and Omnichannel

Celent senior analysts continued their discussion of this year’s winning initiatives.

Karen Monks, Senior Analyst — Operational Excellence

Juan Mazzini, Senior Analyst — Digital and Omnichannel

- 3:00pm Model Insurer Awards Presentation: Digital, Analytics and AI Craig Beattie, Senior Analyst

-

11:30 a.m.

Welcoming Remarks and Model Insurer 2019 Overview

Karlyn Carnahan. Head, P/C, Insurance

-

- 11:30 a.m. Welcoming Remarks Dan Latimore, Head, Retail Banking

-

Model Bank 2019 Overview

Zilvinas Bareisis, Senior Analyst, Celent

We kicked off with an overview of the Model Bank program in 2019: the number of nominations, their geographic spread, and most importantly, the overarching themes setting the innovation agenda in banking today.

-

Model Bank Awards Presentation

Celent Analysts announced the winners of specific awards and discussed their initiatives.

Stephen Greer, Retail Banking — Best Digital Bank

Patricia Hines, Head, Corporate Banking — Banking-as-a-Platform, Marketplace Banking

Zilvinas Bareisis, Cards and Payments — Business Model Innovation, Beyond Banking, Identity Management, Payment Services Hub Implementation

Joan McGowan, Banking and Risk — Risk Management, Product Automation

Bob Meara, Retail Banking — Innovation Enablement, Customer Engagement

-

Featured Speaker: How Software is Eating the Network

Roji Oommen, Managing Director, Global Accounts, CenturyLink

An overview of how the cloud revolution is changing network architecture and the implications for financial services firms.

- 1:00 pm Networking Luncheon

-

2:00 pm

Model Bank Awards Presentation

Celent analysts continued the presentation of award-winning initiatives.

Alenka Grealish, Corporate Banking — Customer Insight, Employee Enablement, Corporate Payments Transformation, Commercial Customer Onboarding

Craig Focardi, Retail Banking — Lending, Digital Platform Transformation

Stephen Greer, Retail Banking — Core Technology Replatforming, Cloud Adoption

Dan Latimore, Head, Retail Banking — Financial Inclusion

Patricia Hines, Head, Corporate Banking — API Strategy, Transforming Enterprise Integration

-

3:00 p.m.

Model Bank of the Year

Patricia Hines, Head, Corporate Banking

Citi walked away with this year’s top honor.

-

- 11:30 a.m. Welcoming Remarks Will Trout, Head, Wealth Management

-

Model Wealth Manager Awards Presentation

Celent analysts shared who won and revealed what about the initiatives impressed them so.

David Himmel, Research Associate — Client Experience, Emerging Innovation

Will Trout, Head, Wealth Management — Platform and Product

-

Model Wealth Manager Awards Panel

Moderator: David Easthope, Head, Capital Markets

Featuring: Will Trout, Head, Wealth Management; Model Wealth Manager Award Winners

-

Know Your Vendor — Celent’s VendorMatch

Featuring: Will Trout, Head, Wealth Management; Participating Vendors

- 1:00 pm Networking Luncheon

-

2:00 pm

Model Asset Manager Awards Presentation

Celent analysts continued with the celebration of this year’s award-winning initiatives.

Neil Katkov, PhD Head, Risk — Innovation in Risk

Will Trout, Head, Wealth Management — Distribution

David Easthope, Head, Capital Markets — Core Transformation

-

Model Asset Manager Awards Panel

Featuring: Brad Bailey, Research Director; David Easthope, Head, Capital Markets; Neil Katkov, PhD, Head, Risk; Model Asset Manager Award Winners

-

Know Your Vendor — Celent’s VendorMatch

Featuring: David Easthope, Head, Capital Markets; Participating Vendors

-

3:00 pm

Analyst Showcase: Emerging Wealth and Asset Management Technology Panel

Moderator: David Easthope, Head, Capital Markets

Featuring: Brad Bailey, Research Director; John Dwyer, Senior Analyst; Neil Katkov, PhD, Head, Risk; Arin Ray, Senior Analyst; Will Trout, Head, Wealth Management

- 3:30 p.m. Networking Break

-

4:00 p.m.

Plenary Session: The Tongue Can Paint What the Eyes Can’t See — Sponsored by Intellect SEEC

Lakshan De Silva, Chief Technology Officer, Intellect SEEC; Mike Fitzgerald, Senior Analyst, Celent; Alenka Grealish, Senior Analyst, Celent

With Alexa, Siri and Google all relentlessly promoting Voice as a screen-free way to interact with technology, it is understandable how Voice could be viewed by some to be the next frontier of customer engagement. But what is the future of Voice in Financial Services? Is it destined to be the next big thing that never was? Or a must-have transformative technology that FIs will need to adopt or risk becoming obsolete? Two Celent analysts debated the Future of Voice in an Oxford-style debate. Also featured was session sponsor Intellect Design who discussed their work around testing different voice engines against different AI back-ends and how they are looking for the optimal means of joining the two.

- 4:30 p.m. Closing Remarks Jamie Macgregor, CEO, Celent

- 4:45 p.m. Cocktail Reception and Raffle Giveaway

Speakers

Keynote Speaker

-

Greg Baxter

Executive Vice President, Chief Digital Officer

MetLife

Greg Baxter is Executive Vice President and Chief Digital Officer at MetLife. Building on a career in technology, strategy and innovation, Greg is responsible for driving MetLife’s Digital strategy and execution globally. This includes setting the direction for MetLife’s Digital capability development and investments across foundational, differentiating and disruptive opportunities, and the incubation and acceleration of Digital growth opportunities. Greg has held senior business, consulting and technology roles across Asia, Europe and North America. Prior to MetLife, Greg was Managing Director and Global Head of Digital at Citi in New York, leading their digital transformation globally. Before Citi, Greg was a London based Partner and U.K. Board member at Booz & Company (formerly Booz Allen Hamilton), a leading management consulting firm. Here he held leadership roles across the financial services, public sector and digital practices. Greg started his career in Australia as a software engineer and senior project manager with IBM, delivering large technology projects in financial services and managing market leading products. Greg is a leading thinker and regular speaker on digital strategy, technology and disruptive innovation, and has been a guest lecturer on strategy at Oxford University, New York University and the American University in Washington. Greg has served on the Council (Board member) of Chatham House — the Royal Institute of International Affairs, a leading international affairs think tank. He also serves as an economic advisor to the Governor of Guangdong Province in China and is on the advisory board for Imperial College’s Centre for Global Finance and Technology in London.

Greg Baxter

Executive Vice President, Chief Digital Officer

MetLife

Greg Baxter is Executive Vice President and Chief Digital Officer at MetLife. Building on a career in technology, strategy and innovation, Greg is responsible for driving MetLife’s Digital strategy and execution globally. This includes setting the direction for MetLife’s Digital capability development and investments across foundational, differentiating and disruptive opportunities, and the incubation and acceleration of Digital growth opportunities. Greg has held senior business, consulting and technology roles across Asia, Europe and North America. Prior to MetLife, Greg was Managing Director and Global Head of Digital at Citi in New York, leading their digital transformation globally. Before Citi, Greg was a London based Partner and U.K. Board member at Booz & Company (formerly Booz Allen Hamilton), a leading management consulting firm. Here he held leadership roles across the financial services, public sector and digital practices. Greg started his career in Australia as a software engineer and senior project manager with IBM, delivering large technology projects in financial services and managing market leading products. Greg is a leading thinker and regular speaker on digital strategy, technology and disruptive innovation, and has been a guest lecturer on strategy at Oxford University, New York University and the American University in Washington. Greg has served on the Council (Board member) of Chatham House — the Royal Institute of International Affairs, a leading international affairs think tank. He also serves as an economic advisor to the Governor of Guangdong Province in China and is on the advisory board for Imperial College’s Centre for Global Finance and Technology in London.

-

Jamie Macgregor

CEO

Celent

Jamie Macgregor is the CEO of Celent and is based in our London office. Within Celent, Jamie has led the development of Celent’s innovation framework and has been a major contributor to shaping Celent’s global insurance agenda. His research focuses on IT strategy and the technology challenges facing the European life and pensions market, contributing to the debate around innovation, digital transformation, BPO strategies, the impact of regulation, and the insurtech / fintech arena. Jamie’s career spans over 25 years in both management consulting and the insurance industry. Prior to joining Celent, Jamie was a Senior Manager within Deloitte’s management consulting practice, where he led engagements focused on helping clients develop their IT strategy aligned to their business goals, post-M&A integration, and enterprise architecture. While at Deloitte, Jamie also directed the learning and development programme for the Architecture & Analysis capability, and was a core team member contributing to the development of both the Insurance Core Systems Transformation proposition and the technology implications of the Retail Distribution Review Readiness proposition for the UK Life, Pensions and Wealth Management market. While in industry, Jamie performed a number of key lead IT / Business interface roles, such as Head of IT Strategy for AXA UK & Ireland, and led change delivery at both AIG and Zurich Financial Services.

Jamie Macgregor

CEO

Celent

Jamie Macgregor is the CEO of Celent and is based in our London office. Within Celent, Jamie has led the development of Celent’s innovation framework and has been a major contributor to shaping Celent’s global insurance agenda. His research focuses on IT strategy and the technology challenges facing the European life and pensions market, contributing to the debate around innovation, digital transformation, BPO strategies, the impact of regulation, and the insurtech / fintech arena. Jamie’s career spans over 25 years in both management consulting and the insurance industry. Prior to joining Celent, Jamie was a Senior Manager within Deloitte’s management consulting practice, where he led engagements focused on helping clients develop their IT strategy aligned to their business goals, post-M&A integration, and enterprise architecture. While at Deloitte, Jamie also directed the learning and development programme for the Architecture & Analysis capability, and was a core team member contributing to the development of both the Insurance Core Systems Transformation proposition and the technology implications of the Retail Distribution Review Readiness proposition for the UK Life, Pensions and Wealth Management market. While in industry, Jamie performed a number of key lead IT / Business interface roles, such as Head of IT Strategy for AXA UK & Ireland, and led change delivery at both AIG and Zurich Financial Services.

Featured Speakers

-

Lakshan de Silva

Chief Technology Officer

Intellect SEEC

Lakshan is an experienced global executive that has worked across technology, venture capital, insurance, wealth management, construction, manufacturing and mining. He has worked in corporations across the globe and has rounded it off with an MBA and a couple of Exec Programs, but please don’t hold that against him, as he is busily unlearning everything he learnt over the last 20 years to stay relevant for the next 20 years. As CTO, he is bringing in exponential technology that will define the next 10 years into the Intellect SEEC products. His current projects revolve around AI and Blockchain. He holds global patents in several technologies and is an investor and advisor to numerous Fintech startups. He is a sports fan, music aficionado and animal lover and his claim to fame is that he has trained his pet bulldog Mortimer to obey him whenever the bulldog wants to.

Lakshan de Silva

Chief Technology Officer

Intellect SEEC

Lakshan is an experienced global executive that has worked across technology, venture capital, insurance, wealth management, construction, manufacturing and mining. He has worked in corporations across the globe and has rounded it off with an MBA and a couple of Exec Programs, but please don’t hold that against him, as he is busily unlearning everything he learnt over the last 20 years to stay relevant for the next 20 years. As CTO, he is bringing in exponential technology that will define the next 10 years into the Intellect SEEC products. His current projects revolve around AI and Blockchain. He holds global patents in several technologies and is an investor and advisor to numerous Fintech startups. He is a sports fan, music aficionado and animal lover and his claim to fame is that he has trained his pet bulldog Mortimer to obey him whenever the bulldog wants to.

-

Travis North

Vice President, Group Architecture and Innovation

Argo Group

Travis currently leads Architecture and Innovation for Argo Group, helping IT develop the platform of the future to serve all aspects of the business; from distribution to underwriting, claims and beyond. Prior to leading this team, Travis held multiple roles across Argo supporting various core systems and enterprise applications.

Travis North

Vice President, Group Architecture and Innovation

Argo Group

Travis currently leads Architecture and Innovation for Argo Group, helping IT develop the platform of the future to serve all aspects of the business; from distribution to underwriting, claims and beyond. Prior to leading this team, Travis held multiple roles across Argo supporting various core systems and enterprise applications.

-

Roji Oommen

Managing Director, Global Accounts

CenturyLink

Roji is currently responsible for business development, strategy as well as alliances and partnerships within CenturyLink’s Global Accounts business segment, working very closely with the 200+ customers that make up this vertical to deliver purpose-built IT infrastructure and connectivity solutions. CenturyLink is a leader in global interconnectivity, cloud and technology infrastructure, and IT solutions for enterprises. Roji has more than 15 years of experience, at organizations such as Thomson Reuters, IBM and Bridge Information Systems, specializing in information technology for financial services firms.

Roji Oommen

Managing Director, Global Accounts

CenturyLink

Roji is currently responsible for business development, strategy as well as alliances and partnerships within CenturyLink’s Global Accounts business segment, working very closely with the 200+ customers that make up this vertical to deliver purpose-built IT infrastructure and connectivity solutions. CenturyLink is a leader in global interconnectivity, cloud and technology infrastructure, and IT solutions for enterprises. Roji has more than 15 years of experience, at organizations such as Thomson Reuters, IBM and Bridge Information Systems, specializing in information technology for financial services firms.

Banking Speakers

-

Dan Latimore

Head, Retail Banking

Celent

Daniel W. Latimore, CFA, is the Head of Celent’s Retail Banking Group and is based in the firm’s Boston office. Dan’s areas of focus include consumer behavior, innovation, and technology-enabled strategy. Dan has been widely quoted in the press, including the Boston Globe, CNBC and CNBC Europe, and American Banker. He has been a frequent speaker at industry conferences and client presentations, having delivered addresses in more than a dozen countries to audiences ranging from intimate meetings with CEOs and central banks to keynote speeches to 800 people. He has held senior management positions in research groups at Deloitte and IBM, has worked in industry at Merrill Lynch and Liberty Mutual, and was a consultant at McKinsey & Co.

Dan Latimore

Head, Retail Banking

Celent

Daniel W. Latimore, CFA, is the Head of Celent’s Retail Banking Group and is based in the firm’s Boston office. Dan’s areas of focus include consumer behavior, innovation, and technology-enabled strategy. Dan has been widely quoted in the press, including the Boston Globe, CNBC and CNBC Europe, and American Banker. He has been a frequent speaker at industry conferences and client presentations, having delivered addresses in more than a dozen countries to audiences ranging from intimate meetings with CEOs and central banks to keynote speeches to 800 people. He has held senior management positions in research groups at Deloitte and IBM, has worked in industry at Merrill Lynch and Liberty Mutual, and was a consultant at McKinsey & Co.

-

Zilvinas Bareisis

Senior Analyst, Payments

Celent

Zilvinas Bareisis is a Senior Analyst and is based in our London office. He researches and advises clients on consumer payments. He has a keen interest in payments innovation, and how the “perfect storm” of competitive (e.g. Fintech), regulatory (e.g. EMV, PSD2), and technology (e.g. digital, blockchain, Internet of Things) developments shapes consumer payments today and tomorrow. Zil has a global perspective with a particular emphasis on market developments in North America and Europe. Zil is a regular speaker, chairman, and panel moderator at the leading payments industry events. He has also been widely quoted in the press. He has over 20 years of experience advising senior executives at the leading financial institutions and their technology and service providers. Zil joined Celent from Oliver Wyman where as a management consultant he advised clients on a broad range of strategic issues.

Zilvinas Bareisis

Senior Analyst, Payments

Celent

Zilvinas Bareisis is a Senior Analyst and is based in our London office. He researches and advises clients on consumer payments. He has a keen interest in payments innovation, and how the “perfect storm” of competitive (e.g. Fintech), regulatory (e.g. EMV, PSD2), and technology (e.g. digital, blockchain, Internet of Things) developments shapes consumer payments today and tomorrow. Zil has a global perspective with a particular emphasis on market developments in North America and Europe. Zil is a regular speaker, chairman, and panel moderator at the leading payments industry events. He has also been widely quoted in the press. He has over 20 years of experience advising senior executives at the leading financial institutions and their technology and service providers. Zil joined Celent from Oliver Wyman where as a management consultant he advised clients on a broad range of strategic issues.

-

Craig Focardi

Senior Analyst, Corporate Banking

Celent

Craig Focardi is a Senior Analyst and is based in our San Francisco office. Craig’s coverage areas include digital lending strategy, market sizing, and technology selection across the credit lifecycle for all consumer credit products. His advisory engagements have included core lending and banking system vendor selection for financial institutions, market feasibility and go-to market assessments for technology vendors, and technology provider acquisition due diligence for FinTech investors. Craig is a frequent speaker and moderator at industry conferences. He has also written dozens of bylined articles. Craig began his career in economics and finance and marketing in the mortgage industry for lenders and IT vendors, including The Federal Home Loan Bank, The PMI Group, Wells Fargo, and CoreLogic. Craig then spent 16 years as a banking industry analyst at TowerGroup and CEB prior to joining Celent.

Craig Focardi

Senior Analyst, Corporate Banking

Celent

Craig Focardi is a Senior Analyst and is based in our San Francisco office. Craig’s coverage areas include digital lending strategy, market sizing, and technology selection across the credit lifecycle for all consumer credit products. His advisory engagements have included core lending and banking system vendor selection for financial institutions, market feasibility and go-to market assessments for technology vendors, and technology provider acquisition due diligence for FinTech investors. Craig is a frequent speaker and moderator at industry conferences. He has also written dozens of bylined articles. Craig began his career in economics and finance and marketing in the mortgage industry for lenders and IT vendors, including The Federal Home Loan Bank, The PMI Group, Wells Fargo, and CoreLogic. Craig then spent 16 years as a banking industry analyst at TowerGroup and CEB prior to joining Celent.

-

Alenka Grealish

Senior Analyst, Corporate Banking

Celent

Alenka is a Senior Analyst and is based in our San Francisco office. She has over 20 years of consulting and research experience in the banking industry with deep expertise in payments, transaction banking, and commercial banking. Her research focuses on innovation in treasury management services, trade finance, working capital finance, and the implications for customer journeys across segments, including small business. Alenka has advised top banks on their business and technology strategies. Her consulting work has included the development of a growth strategy for the treasury management business of a leading North American bank, examination of cross-border growth opportunities in treasury management for a top European bank, and the identification and evaluation of opportunities to enable small to medium-sized businesses to automate their payment processes. Prior to rejoining Celent, she worked for The Boston Consulting Group, where she was the global segment manager for transaction banking and payments. She started her career as an associate economist at the Federal Reserve Bank of Chicago.

Alenka Grealish

Senior Analyst, Corporate Banking

Celent

Alenka is a Senior Analyst and is based in our San Francisco office. She has over 20 years of consulting and research experience in the banking industry with deep expertise in payments, transaction banking, and commercial banking. Her research focuses on innovation in treasury management services, trade finance, working capital finance, and the implications for customer journeys across segments, including small business. Alenka has advised top banks on their business and technology strategies. Her consulting work has included the development of a growth strategy for the treasury management business of a leading North American bank, examination of cross-border growth opportunities in treasury management for a top European bank, and the identification and evaluation of opportunities to enable small to medium-sized businesses to automate their payment processes. Prior to rejoining Celent, she worked for The Boston Consulting Group, where she was the global segment manager for transaction banking and payments. She started her career as an associate economist at the Federal Reserve Bank of Chicago.

-

Stephen Greer

Senior Analyst, Banking

Celent

Stephen Greer is a Senior Analyst and is based in New York City. He focuses on retail banking trends, with an emphasis on fintech startups, emerging technology, and digital transformation. He has worked with some of the largest banks in the US and around the globe to influence digital strategies and identify opportunities in the space. Prior to his current home in New York, Stephen was based out of Madrid, concentrating on issues related to banking across Europe. Stephen’s recent consulting work includes: market entry strategy for a global financial services vendor, market opportunity assessment for a large tier 1, and digital transformation strategic assessment for large tier 1 bank. Stephen has been a frequent speaker at large conferences as well as at industry roundtables and vendor events. He has been quoted in publications such as Forbes, The San Francisco Chronicle, American Banker, Banking Exchange, and others.

Stephen Greer

Senior Analyst, Banking

Celent

Stephen Greer is a Senior Analyst and is based in New York City. He focuses on retail banking trends, with an emphasis on fintech startups, emerging technology, and digital transformation. He has worked with some of the largest banks in the US and around the globe to influence digital strategies and identify opportunities in the space. Prior to his current home in New York, Stephen was based out of Madrid, concentrating on issues related to banking across Europe. Stephen’s recent consulting work includes: market entry strategy for a global financial services vendor, market opportunity assessment for a large tier 1, and digital transformation strategic assessment for large tier 1 bank. Stephen has been a frequent speaker at large conferences as well as at industry roundtables and vendor events. He has been quoted in publications such as Forbes, The San Francisco Chronicle, American Banker, Banking Exchange, and others.

-

Patricia Hines

CTP Head, Corporate Banking

Celent

Patricia Hines, CTP, is Head of Corporate Banking and is based in Charlotte, North Carolina. Her areas of research include global transaction services and wholesale banking with a particular emphasis on treasury and cash management, corporate banking delivery channels, and trade and supply chain finance, along with commercial and small business lending. Patty has over 20 years of experience in financial services. Prior to Celent, she was a Research Director in Wholesale Banking at CEB TowerGroup, where she conducted primary research focused on industry trends, strategic business drivers, and technology solutions in commercial lending and small business services.

Patricia Hines

CTP Head, Corporate Banking

Celent

Patricia Hines, CTP, is Head of Corporate Banking and is based in Charlotte, North Carolina. Her areas of research include global transaction services and wholesale banking with a particular emphasis on treasury and cash management, corporate banking delivery channels, and trade and supply chain finance, along with commercial and small business lending. Patty has over 20 years of experience in financial services. Prior to Celent, she was a Research Director in Wholesale Banking at CEB TowerGroup, where she conducted primary research focused on industry trends, strategic business drivers, and technology solutions in commercial lending and small business services.

-

Joan McGowan

Senior Analyst, Risk

Celent

Joan McGowan is a Senior Analyst and is based in Atlanta, Georgia. Her research focus is on risk management, regulatory compliance, data security, and data analytics, with a concentration on disruptive technologies for risk transparency and data visualization. She brings a “risk-reward” perspective to strategic decision-making. Joan has over 15 years of experience with technology and growth strategies for global financial markets. She has worked as a Senior Strategist with the leading financial service technology providers FIS Global, Fiserv, and FICO, serving global, international, regional, and midsize banks and credit unions. Prior to that, Joan was a Researcher for BBC North News, and a Managing Editor for The Economist Group.

Joan McGowan

Senior Analyst, Risk

Celent

Joan McGowan is a Senior Analyst and is based in Atlanta, Georgia. Her research focus is on risk management, regulatory compliance, data security, and data analytics, with a concentration on disruptive technologies for risk transparency and data visualization. She brings a “risk-reward” perspective to strategic decision-making. Joan has over 15 years of experience with technology and growth strategies for global financial markets. She has worked as a Senior Strategist with the leading financial service technology providers FIS Global, Fiserv, and FICO, serving global, international, regional, and midsize banks and credit unions. Prior to that, Joan was a Researcher for BBC North News, and a Managing Editor for The Economist Group.

-

Bob Meara

Senior Analyst, Banking

Celent

Bob Meara is a Senior Analyst and is based in Atlanta, Georgia. His research focuses on the branch and ATM delivery channels, customer analytics and check and cash payment processing technologies. A well-known authority on remote deposit capture, Bob has led multiple consulting engagements, including several proprietary research projects involving financial services hardware, software and the impact of self-service on branch banking. Before joining Celent, Bob was the Director of Product Marketing at Alogent. In this role, he positioned and launched a series of Check 21 payments solutions. Prior to Alogent, Bob also held positions at Stonebridge Technologies, Telemate.net Software, BellSouth, Hayes Corporation, and Procter & Gamble in addition to being a commissioned naval officer.

Bob Meara

Senior Analyst, Banking

Celent

Bob Meara is a Senior Analyst and is based in Atlanta, Georgia. His research focuses on the branch and ATM delivery channels, customer analytics and check and cash payment processing technologies. A well-known authority on remote deposit capture, Bob has led multiple consulting engagements, including several proprietary research projects involving financial services hardware, software and the impact of self-service on branch banking. Before joining Celent, Bob was the Director of Product Marketing at Alogent. In this role, he positioned and launched a series of Check 21 payments solutions. Prior to Alogent, Bob also held positions at Stonebridge Technologies, Telemate.net Software, BellSouth, Hayes Corporation, and Procter & Gamble in addition to being a commissioned naval officer.

Insurance Speakers

-

John Barr

Senior Analyst

Celent

John Barr is a Senior Analyst providing research, advisory and consulting services to carriers, software, and service providers to the life, annuity, and general insurance industries. Prior to joining Celent, John provided strategic information technology and transformation consulting to a number of firms including EquiSoft/UCT, Transamerica, Genpact, and Pacific Life. He also recently served as EXL Services’ Vice President of Insurance Product Management and Operations Consulting. John has 25+ years of experience in management and executive roles with information technology, consulting services, and insurance companies. He has led the development of insurance business advisory and professional services organizations, and directed global insurance vertical product and services organizations. John brings deep domain expertise across the life, annuity, pensions, and P&C insurance spectrum, and has held leadership positions with Wipro, Capgemini, and CSC/Continuum, and served as CIO of Texas Workers Compensation Insurance (now Texas Mutual).

John Barr

Senior Analyst

Celent

John Barr is a Senior Analyst providing research, advisory and consulting services to carriers, software, and service providers to the life, annuity, and general insurance industries. Prior to joining Celent, John provided strategic information technology and transformation consulting to a number of firms including EquiSoft/UCT, Transamerica, Genpact, and Pacific Life. He also recently served as EXL Services’ Vice President of Insurance Product Management and Operations Consulting. John has 25+ years of experience in management and executive roles with information technology, consulting services, and insurance companies. He has led the development of insurance business advisory and professional services organizations, and directed global insurance vertical product and services organizations. John brings deep domain expertise across the life, annuity, pensions, and P&C insurance spectrum, and has held leadership positions with Wipro, Capgemini, and CSC/Continuum, and served as CIO of Texas Workers Compensation Insurance (now Texas Mutual).

-

Craig Beattie

Senior Analyst, Insurance

Celent

Craig Beattie is a Senior Analyst and is based in our London office. He brings extensive experience in the use of enterprise architecture and applications architecture practices in the insurance industry, working with and within insurers. Craig has advised insurers on IT strategy, legacy modernization, insurance vendor analysis and enterprise architecture topics, principally in the EMEA region. Since joining Celent, he has been a speaker at industry events in North America and London, as well as Celent events in Europe. He has spoken on topics such as the influence of mobile on the industry, the use of social networks by insurers and how the evolving use of the Internet, data and IoT will influence insurance in the future. Recent consulting clients have engaged Craig for policy administration vendor analyses, market entry strategies, and product messaging work for insurance vendors. Prior to joining Celent, Craig was an applications architect with Royal Bank of Scotland Group’s Strategy and Architecture team, working extensively with RBS Insurance.

Craig Beattie

Senior Analyst, Insurance

Celent

Craig Beattie is a Senior Analyst and is based in our London office. He brings extensive experience in the use of enterprise architecture and applications architecture practices in the insurance industry, working with and within insurers. Craig has advised insurers on IT strategy, legacy modernization, insurance vendor analysis and enterprise architecture topics, principally in the EMEA region. Since joining Celent, he has been a speaker at industry events in North America and London, as well as Celent events in Europe. He has spoken on topics such as the influence of mobile on the industry, the use of social networks by insurers and how the evolving use of the Internet, data and IoT will influence insurance in the future. Recent consulting clients have engaged Craig for policy administration vendor analyses, market entry strategies, and product messaging work for insurance vendors. Prior to joining Celent, Craig was an applications architect with Royal Bank of Scotland Group’s Strategy and Architecture team, working extensively with RBS Insurance.

-

Karlyn Carnahan

Head, Property & Casualty Insurance

Celent

Karlyn leads Celent’s Property & Casualty research across the Americas and is based in San Francisco. She focuses on issues related to digital transformation. She’s particularly interested in shifting distribution channels, new ways of enabling and managing channels, underwriting transformation and new products, improving claims, and transforming the customer experience. Karlyn is the lead analyst for questions related to distribution management, underwriting and claims, core systems, and operational excellence. Karlyn’s consulting experience includes numerous systems selection projects across policy admin, billing, claims, loss control, CRM, and other core systems. She has also completed multiple IT organizational assessments, primary market research of insurance agents for carriers, marketing and product roadmap strategies for multiple software vendors and other strategic projects for carriers primarily related to marketing, underwriting and claims. She is frequently asked to present at industry events.

Karlyn Carnahan

Head, Property & Casualty Insurance

Celent

Karlyn leads Celent’s Property & Casualty research across the Americas and is based in San Francisco. She focuses on issues related to digital transformation. She’s particularly interested in shifting distribution channels, new ways of enabling and managing channels, underwriting transformation and new products, improving claims, and transforming the customer experience. Karlyn is the lead analyst for questions related to distribution management, underwriting and claims, core systems, and operational excellence. Karlyn’s consulting experience includes numerous systems selection projects across policy admin, billing, claims, loss control, CRM, and other core systems. She has also completed multiple IT organizational assessments, primary market research of insurance agents for carriers, marketing and product roadmap strategies for multiple software vendors and other strategic projects for carriers primarily related to marketing, underwriting and claims. She is frequently asked to present at industry events.

-

Mike Fitzgerald

Senior Analyst, Insurance

Celent

Mike Fitzgerald is a Senior Analyst with Celent’s Insurance practice based in Cary, North Carolina. His career includes leadership positions in property/casualty automation, operations management and insurance product development. Mike’s research focuses on innovation, billing, business process and operations, social media, and distribution management. Mike brings extensive industry experience to the analyst role. Prior to joining Celent, he was Vice President of Enterprise Underwriting solutions at Zurich North America, where he led the evaluation of technology alternatives to support a new underwriting product development process. He held a number of positions at Royal & Sun Alliance. His technology implementation experience includes the installation and maintenance of billing, automobile policy administration, and workers compensation automation.

Mike Fitzgerald

Senior Analyst, Insurance

Celent

Mike Fitzgerald is a Senior Analyst with Celent’s Insurance practice based in Cary, North Carolina. His career includes leadership positions in property/casualty automation, operations management and insurance product development. Mike’s research focuses on innovation, billing, business process and operations, social media, and distribution management. Mike brings extensive industry experience to the analyst role. Prior to joining Celent, he was Vice President of Enterprise Underwriting solutions at Zurich North America, where he led the evaluation of technology alternatives to support a new underwriting product development process. He held a number of positions at Royal & Sun Alliance. His technology implementation experience includes the installation and maintenance of billing, automobile policy administration, and workers compensation automation.

-

Donald Light

Director, Americas, Property/Casualty Practice

Celent

Donald Light is the Director of Celent’s Americas Property/Casualty Insurance Practice. His research and consulting focuses on: technology and business strategy, policy administration, underwriting, claims, reinsurance, and risk analytics. His recent consulting work includes: developing a strategic IT plan for a specialty insurer, vendor selection advisory work for rating, policy administration, and claims; a build vs. buy analysis for core systems; and several due diligence projects for acquisitions. Donald has been widely quoted in the press and media, including The Wall Street Journal, The New York Times, Financial Times, The Economist, NBC and CBS Evening News, CNBC, and National Public Radio. Prior to joining Celent, Donald was an insurance subject matter expert with Sapient.

Donald Light

Director, Americas, Property/Casualty Practice

Celent

Donald Light is the Director of Celent’s Americas Property/Casualty Insurance Practice. His research and consulting focuses on: technology and business strategy, policy administration, underwriting, claims, reinsurance, and risk analytics. His recent consulting work includes: developing a strategic IT plan for a specialty insurer, vendor selection advisory work for rating, policy administration, and claims; a build vs. buy analysis for core systems; and several due diligence projects for acquisitions. Donald has been widely quoted in the press and media, including The Wall Street Journal, The New York Times, Financial Times, The Economist, NBC and CBS Evening News, CNBC, and National Public Radio. Prior to joining Celent, Donald was an insurance subject matter expert with Sapient.

-

Juan Mazzini

Senior Analyst, Insurance

Celent

Juan Mazzini is a Senior Analyst and is based in Miami, Florida. Responsible for driving research and providing advisory to C-level executives in the financial services industry in themes such as fintech, insurtech, innovation, emerging technology and business transformation. His work includes advising firms based in North America, Latin America, Europe and Asia-Pacific. Juan’s career spans more than 25 years in the insurance and banking IT industries. He is a frequent speaker at industry events, contributor to many conferences, and evaluator for technology competitions. He has also mentoring experience in diverse industries. Prior to joining Celent, Juan was Corporate Vice President at Sistran, where he directly contributed to expanding its presence throughout 14 countries, including the US and key Latin American markets of Mexico, Brazil, Argentina, Colombia, Central America, and the Caribbean. He brings a deep understanding of core and noncore systems projects and operational business models.

Juan Mazzini

Senior Analyst, Insurance

Celent

Juan Mazzini is a Senior Analyst and is based in Miami, Florida. Responsible for driving research and providing advisory to C-level executives in the financial services industry in themes such as fintech, insurtech, innovation, emerging technology and business transformation. His work includes advising firms based in North America, Latin America, Europe and Asia-Pacific. Juan’s career spans more than 25 years in the insurance and banking IT industries. He is a frequent speaker at industry events, contributor to many conferences, and evaluator for technology competitions. He has also mentoring experience in diverse industries. Prior to joining Celent, Juan was Corporate Vice President at Sistran, where he directly contributed to expanding its presence throughout 14 countries, including the US and key Latin American markets of Mexico, Brazil, Argentina, Colombia, Central America, and the Caribbean. He brings a deep understanding of core and noncore systems projects and operational business models.

-

Karen Monks

Senior Analyst, Insurance

Celent

Karen is a Senior Analyst in Celent’s insurance practice and is based in Richmond, Virginia. She brings a broad range of insurance and consulting experience to her work; she has worked as a management consultant to and within insurance carriers and other financial services companies for over 20 years. Karen’s focus is life insurance technology and trends. Her research concentrates on life, all aspects of life insurance processing including illustrations, eApplications and eSignature, new business and underwriting systems, policy administration systems, claims systems, and digital enablement technologies. Past consulting projects include a vendor product strategy review, life claims system benchmarking project, a marketing and distribution management systems review, an eApplication cost analysis, plus several small life insurance technology analyses. In addition to her analyst duties, Karen leads Celent’s Knowledge Management team which leads our largest research initiatives, particularly our ABCD Vendor assessments across all practices.

Karen Monks

Senior Analyst, Insurance

Celent

Karen is a Senior Analyst in Celent’s insurance practice and is based in Richmond, Virginia. She brings a broad range of insurance and consulting experience to her work; she has worked as a management consultant to and within insurance carriers and other financial services companies for over 20 years. Karen’s focus is life insurance technology and trends. Her research concentrates on life, all aspects of life insurance processing including illustrations, eApplications and eSignature, new business and underwriting systems, policy administration systems, claims systems, and digital enablement technologies. Past consulting projects include a vendor product strategy review, life claims system benchmarking project, a marketing and distribution management systems review, an eApplication cost analysis, plus several small life insurance technology analyses. In addition to her analyst duties, Karen leads Celent’s Knowledge Management team which leads our largest research initiatives, particularly our ABCD Vendor assessments across all practices.

-

Tom Scales

Head, Life and Health Insurance, Americas

Celent

Tom leads life and health research across the Americas. His research focuses on operational best practices, real-world case studies and the application of vendor technology. His particular passion is to challenge life insurers to move faster in innovation as well as operational and IT transformation. He also leads a broad range of consulting projects, such as transformation project health checks, Deep Dive strategies for both insurers and vendors, and a variety of system selection projects. Tom is an industry veteran. His early experience was primarily with vendors, in a broad variety of roles from the most technical to sales and marketing to executive leadership. Later in his career, he led operations and technology for Crump, the nation’s largest life and annuity brokerage. More recently, he led the operations and technology organizations at Transamerica, for their US Life insurance companies, including both agent and worksite companies.

Tom Scales

Head, Life and Health Insurance, Americas

Celent

Tom leads life and health research across the Americas. His research focuses on operational best practices, real-world case studies and the application of vendor technology. His particular passion is to challenge life insurers to move faster in innovation as well as operational and IT transformation. He also leads a broad range of consulting projects, such as transformation project health checks, Deep Dive strategies for both insurers and vendors, and a variety of system selection projects. Tom is an industry veteran. His early experience was primarily with vendors, in a broad variety of roles from the most technical to sales and marketing to executive leadership. Later in his career, he led operations and technology for Crump, the nation’s largest life and annuity brokerage. More recently, he led the operations and technology organizations at Transamerica, for their US Life insurance companies, including both agent and worksite companies.

Wealth and Asset Management Speakers

-

David Easthope

Head, Capital Markets

Celent

David is the Head of Celent’s Capital Markets practice and is based in San Francisco. His expertise lies in electronic trading, market venues, and market structure. David’s research focuses on themes of strategic importance in the capital markets sector, including the evolution of market structure, the development of advanced and algorithmic trading, and innovations in both software and services. His recent consulting work involves advising clients on developing advanced trading platforms and new market venues. He has also advised strategic and private equity investors on innovation and trends to help them make more informed investment decisions in the capital markets arena. David has been widely referenced in the press, including Bloomberg, Financial Times, and CNBC.

David Easthope

Head, Capital Markets

Celent

David is the Head of Celent’s Capital Markets practice and is based in San Francisco. His expertise lies in electronic trading, market venues, and market structure. David’s research focuses on themes of strategic importance in the capital markets sector, including the evolution of market structure, the development of advanced and algorithmic trading, and innovations in both software and services. His recent consulting work involves advising clients on developing advanced trading platforms and new market venues. He has also advised strategic and private equity investors on innovation and trends to help them make more informed investment decisions in the capital markets arena. David has been widely referenced in the press, including Bloomberg, Financial Times, and CNBC.

-

Brad Bailey

Research Director, Capital Markets

Celent

Brad Bailey is a Research Director and is based in the firm’s New York office. He is an expert in electronic trading of equities, foreign exchange derivatives, credit, rates, and futures. His research focus is on emerging technology and trading technology across asset classes. Brad has more than 20 years of Wall Street industry experience in trading, technology, sales, strategy, analysis, and consulting. A noted thought leader, he is quoted in the industry and general press, including: WSJ, Financial Times, Bloomberg Business Week, and Forbes, as well as radio and TV. Prior to Celent, he spent nearly seven years at KCG Holdings (formerly Knight Capital) as the Director of Business Development and Corporate Strategy.

Brad Bailey

Research Director, Capital Markets

Celent

Brad Bailey is a Research Director and is based in the firm’s New York office. He is an expert in electronic trading of equities, foreign exchange derivatives, credit, rates, and futures. His research focus is on emerging technology and trading technology across asset classes. Brad has more than 20 years of Wall Street industry experience in trading, technology, sales, strategy, analysis, and consulting. A noted thought leader, he is quoted in the industry and general press, including: WSJ, Financial Times, Bloomberg Business Week, and Forbes, as well as radio and TV. Prior to Celent, he spent nearly seven years at KCG Holdings (formerly Knight Capital) as the Director of Business Development and Corporate Strategy.

-

David Himmel

Research Associate

Celent

David Himmel is a research associate at Celent providing analytical and knowledge management support to the Insurance and Banking practices. Prior to joining Celent, he worked at TIAA as a business analyst, supporting initiatives across wealth management and retail product divisions. David holds a BA in Political Science from Lesley University.

David Himmel

Research Associate

Celent

David Himmel is a research associate at Celent providing analytical and knowledge management support to the Insurance and Banking practices. Prior to joining Celent, he worked at TIAA as a business analyst, supporting initiatives across wealth management and retail product divisions. David holds a BA in Political Science from Lesley University.

-

Neil Katkov, PhD

Head, Risk

Celent

Neil oversees the Risk Management and Compliance space at Celent and is based in San Francisco. His expertise focuses on financial crime, anti-money laundering and know-your-customer compliance, AML/ KYC technology, and regtech. Neil initiated Celent’s influential research on AML compliance and technology in 2002. He regularly advises leading financial institutions and technology vendors on their business, technology, and compliance strategies. His advisory engagements have included vendor selection for financial institutions, market feasibility studies for financial institutions and technology vendors, and strategic due diligence on a number of the leading compliance vendors. Neil has been widely quoted in the press and is a popular speaker at conferences. Neil previously launched and managed Celent’s presence in Asia for 15 years and helped establish Celent’s market leading position in Japan.

Neil Katkov, PhD

Head, Risk

Celent

Neil oversees the Risk Management and Compliance space at Celent and is based in San Francisco. His expertise focuses on financial crime, anti-money laundering and know-your-customer compliance, AML/ KYC technology, and regtech. Neil initiated Celent’s influential research on AML compliance and technology in 2002. He regularly advises leading financial institutions and technology vendors on their business, technology, and compliance strategies. His advisory engagements have included vendor selection for financial institutions, market feasibility studies for financial institutions and technology vendors, and strategic due diligence on a number of the leading compliance vendors. Neil has been widely quoted in the press and is a popular speaker at conferences. Neil previously launched and managed Celent’s presence in Asia for 15 years and helped establish Celent’s market leading position in Japan.

-

Will Trout

Head, Wealth Management

Celent

William Trout leads our Wealth Management practice and is based in Houston, Texas. His research centers on technology strategy and innovation in the securities, wealth management, and banking industries. He has particular expertise in customer experience, data analytics, segmentation, remote delivery models, and pricing and product design. Within the wealth management arena, his interests include financial planning, investment advisory, retail brokerage, and trust. Prior to joining Celent, Will was head of product and segment development for affluent and high net worth customers within BBVA Compass, as well as a member of the BBVA Group’s global Private Banking management team.

Will Trout

Head, Wealth Management

Celent

William Trout leads our Wealth Management practice and is based in Houston, Texas. His research centers on technology strategy and innovation in the securities, wealth management, and banking industries. He has particular expertise in customer experience, data analytics, segmentation, remote delivery models, and pricing and product design. Within the wealth management arena, his interests include financial planning, investment advisory, retail brokerage, and trust. Prior to joining Celent, Will was head of product and segment development for affluent and high net worth customers within BBVA Compass, as well as a member of the BBVA Group’s global Private Banking management team.