Digital document capture and processing will automate loan origination processes that currently get bogged down in the back office.

Advances in digital lending technology now enable simple loan transactions to be completed in minutes, but for many types of secured loans with multiple documents, loan approval, and funding takes days or weeks. Selecting and implementing the right workflow-driven digital document capture and enterprise content management (ECM) technology will enable financial institutions to accelerate time to revenue, lower compliance risks, and outcompete fintech and branch-based competitors.

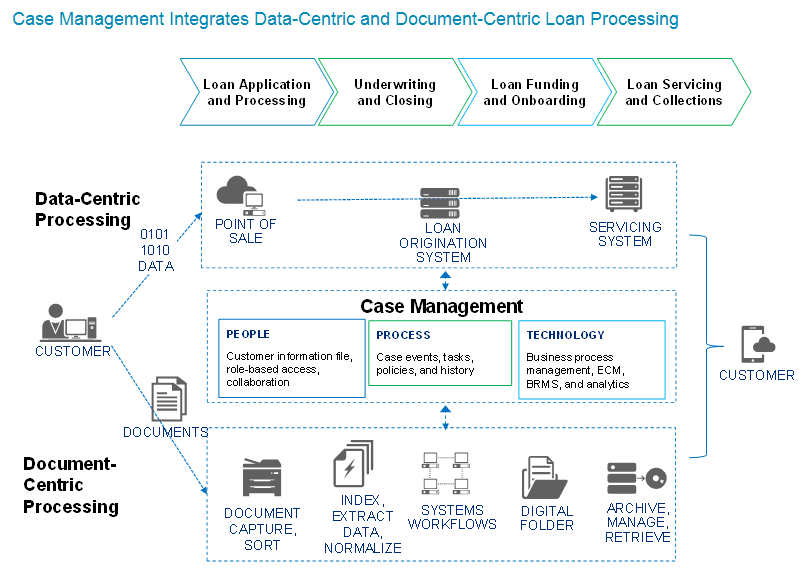

This report analyzes the market, business, and customer imperatives for digital lending transformation; the need for digital document capture and management, and the specific digital document capture, management, and archiving technologies available to make lending digital in both the front office and back office. Creating end-to-end digital mortgage lending process is achievable within the next five years. Ongoing technology innovation — in storage, big data management, web services, document digitization, cloud computing, and mobile — now provides all the IT building blocks needed to integrate core data processing systems with digital documents and case management oversight in mortgage origination, underwriting, closing, onboarding, and servicing.