Over the past decade, China’s regulators have gradually liberalized the interest rates banks can charge. Risk-based pricing will become a core competency of banks in China and lead to more differentiated products and services, particularly for retail and small business customers.

Celent has released a new report titled Interest Rate Liberalization in China: Opportunities for Banks. The report was written by Neil Katkov, PhD, Senior Vice President of Celent’s Asian Financial Services practice.

Over the past decade, China’s regulators have gradually liberalized the interest rates banks can charge. Risk-based pricing will become a core competency of banks in China and lead to more differentiated products and services, particularly for retail and small business customers.

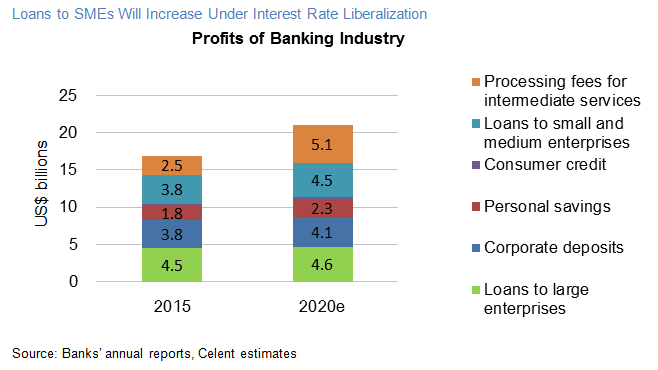

Interest rate liberalization will tend to squeeze margins at banks and increase their need for risk management. For banks with strong risk-based pricing competencies, liberalization will also provide new business opportunities.

It will also cause greater interest rate fluctuations, thereby increasing interest rate risk in the banking industry and causing an increase in demand for interest rate risk instruments. To realize the opportunities in deregulated interest rates, banks are advised to enhance their risk-based pricing competencies, create online banking and social banking services, and develop more high-yield products.

“With interest rate liberalization, a bank’s control over the cost of capital will be a reflection of its competitiveness. In this environment, banks will need to develop digital banking and social banking services to lower their costs in attracting deposits,” Katkov said.

“Interest rate liberalization will intensify competition, narrowing the gap in interest spread, affecting the expansion of credit, increasing credit risks, and increasing the need for the development of value-added services,” he added.