Now that the impact of the pandemic has begun to recede, banks in Asia Pacific are back to focusing solely on growth. While there are both political and macroeconomic challenges ahead, innovation tops the agenda for 2022, and technology investment will underpin much of this change.

With all the talk of the industry moving to a 'New Normal', Celent launched its Banking IT Strategy Survey (CBISS) at the end of 2021 to understand exactly what this means. Through a series of detailed conversations with close to 200 retail banks, we have captured granular insights into the technology strategies and investment priorities of the industry. One thing is clear; there is no suggestion that technology spending will slow any time soon. Financial institutions across Asia Pacific report strongly expanding IT budgets for 2022 and these are being applied to a range of enhancements to product and the user experience, in addition to operational improvements.

This report provides detailed perspectives on the investment and strategic imperatives of banks in Asia Pacific.

Key findings include:

- 74% of banks believe that the threat from fintechs and challenger banks is greater than a year ago

- 58% are investing in identity-related initiatives as a priority for 2022

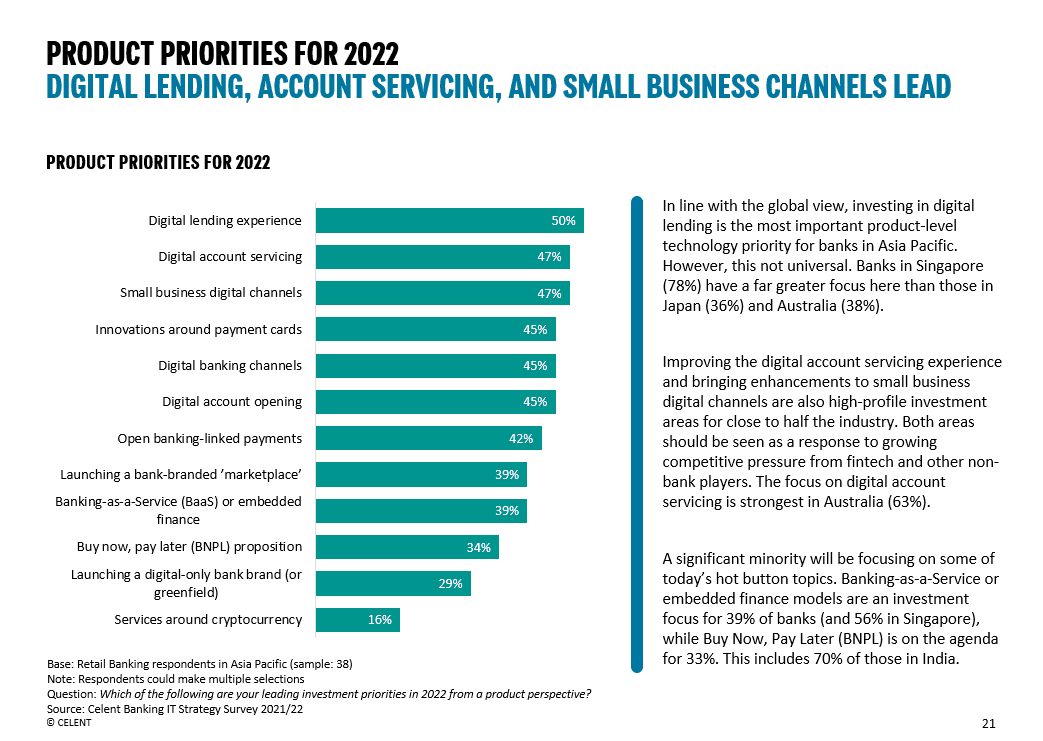

- 50% of banks are investing in the digital lending experience, making it the single biggest product priority

- 82% expect to see more of their workloads move into public cloud infrastructure this year

- 82% report that their institution has a clear strategy to engage with the open ecosystem

The lessons for the industry are clear. Product enhancement and innovation is a leading strategic priority for banks in Asia Pacific in 2022. Those that don’t invest risk falling behind the market.