The traditional way of signing documents is changing. Paperless processes require electronic signatures.

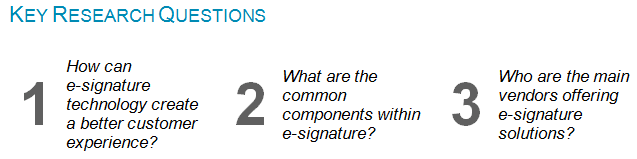

Celent has released a new report titled Putting a Lock on Straight-Through Processing: Life Insurance E-Signature Vendors 2017. The report was written by Karen Monks and Colleen Risk, Analysts in Celent’s Insurance practice.

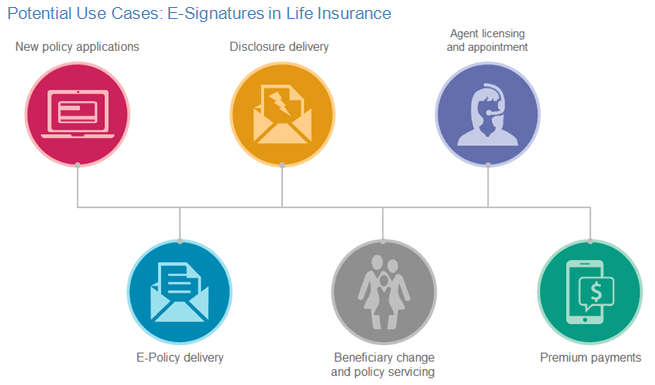

The future of business is digital, and the adoption of mobile technology is driving change. The trend to digitize and transform business is accelerating. Insurance leaders and analysts agree that it is time to remove paper from everyday processes. As a result, the traditional way of signing documents is changing. Paperless processes require electronic signatures.

When deciding on an e-signature vendor, insurers should ensure that the following components are provided by the system:

- Allow both sender and recipient users to sign documents on a variety of devices and operating systems.

- Encrypt and secure communications and shared documents between the users of the solution.

- Track document status and notify users when actions are required

(sign, approve, etc.).

Vendors profiled in this report include Adobe, AlphaTrust, SignNow by Barracuda, DocuSign, eOriginal, eSignLive by Vasco (was Silanis), Euronovate, InsureSign, Kofax by Lexmark, NamirialGmbh (which bought XYZMo), and SIGNiX.

“Adoption of e-signature technology is expanding rapidly for life insurance,” said Risk, a Senior Analyst. “The reduction in both cycle time and cost provides a compelling reason to embrace electric signatures.”

“The vendors in this report represent a large percentage of the client base using

e-signature in life insurance,” suggests Monks, an Analyst. “This report should help life insurers feel comfortable in selecting a vendor who understands the needs of a life insurer.”