The race is on to get lean and agile. Unfortunately, capital markets firms continue to struggle with common operational and technology challenges — siloed business lines, fragmented operations, inflexible technology, inefficient data management, and a heavy reliance on manual effort. These struggles have major implications not only for financial performance but also for how firms manage clients, trades, investments, and compliance.

There is hope. In 2020 and beyond, capital markets firms are faced with an array of strategic technology choices. Many of these technologies have the potential to transform firms on a huge scale. However, there are trade-offs in terms of the amount of effort and skill required. In addition, there is significant implementation risk.

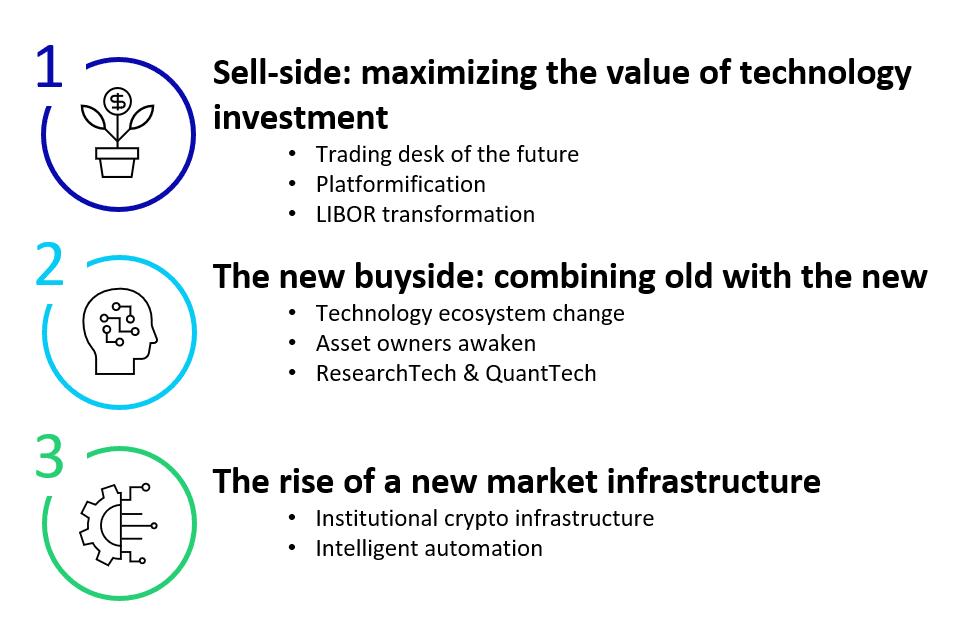

The sell side is maximizing the value of its technology investments by desiloing, making truly strategic technology choices (including partnerships and platforms), and creating internal processes that tie the business closer to technology. Doing so while not being distracted by major transformations (e.g., LIBOR) is a challenge for 2020 and beyond.

Top Technology Drivers in 2020 for Capital Markets Firms

Source: Celent

To move to the future, buy side firms are combining older systems with new, and leveraging technology such as cloud, big data, advanced analytics, APIs, and machine learning. Once slumbering giants, asset owners are also awakening to the challenges of increased transparency requirements. ResearchTech and QuantTech are providing opportunities for firms to re-invent investment decisions and associated risk management.

Finally, market infrastructures are tapping into technologies (cloud, APIs, machine learning) to stay relevant. 2020 is also shaping up to be the year that bitcoinization of the global capital markets begins in earnest. Institutional-grade technology is arriving as we move into the era of regulatory and institutional legitimacy for this new asset class. Intelligent automation also offers great efficiency gains in the post-trade infrastructure across the industry.