Smaller financial institutions face their own challenges when complying with the operational, regulatory, and technical requirements of AML programs with smaller budgets and operational teams, and limited technology infrastructure and internal resources for IT development.

Anti-money laundering software solutions are crucial supports for AML compliance at financial institutions. Yet rising compliance costs and operational burdens around AML compliance have proved challenging.

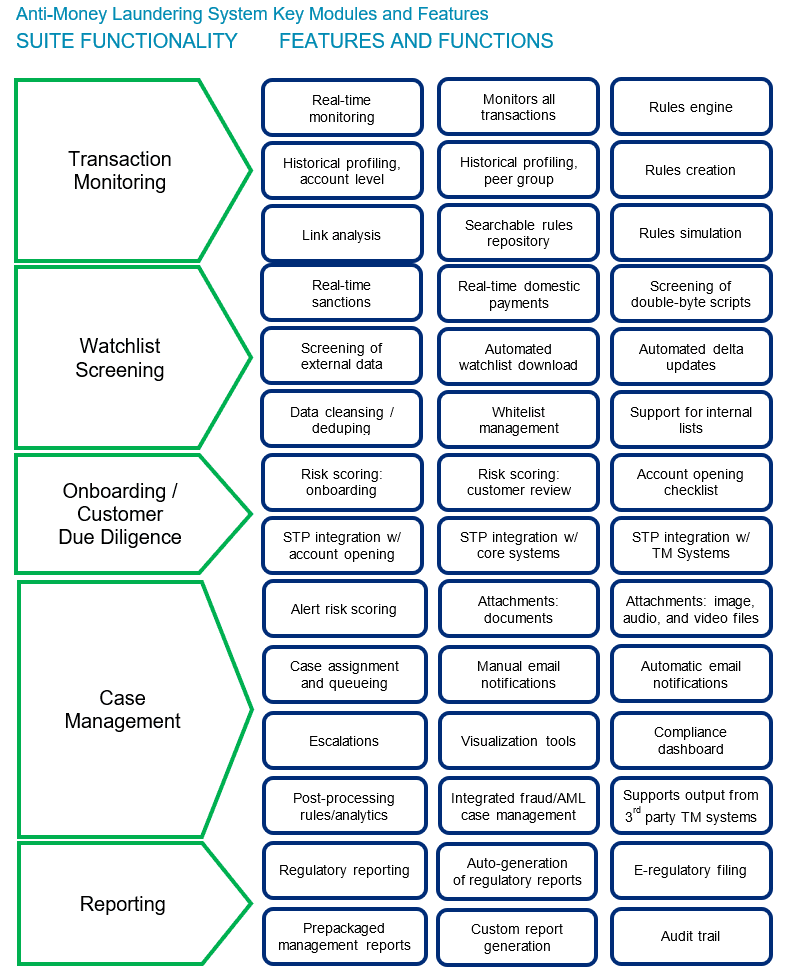

This report examines AML systems targeted primarily at smaller financial institutions. The profiles evaluate both transaction monitoring and watchlist screening, the two essential components of AML systems, as well as the case management and reporting capabilities of the solutions.

The report also evaluates vendors that provided client references using Celent’s ABCD Vendor View. This is a standard representation of a vendor marketplace designed to show at a glance the relative positions of each vendor in four categories: Advanced and flexible technology, Breadth of functionality, Customer base (i.e., relative number and distribution of customers), and Depth of client services.