Banks are at an inflection point and the curve of opportunity is steep. Given technological advances, they can change the game in both customer transactions and engagement.

As evidenced by the digital beacons, raising the bar on customer engagement leads to new products/services, improvements to existing products, distribution opportunities, and attendant revenue streams. Those that achieve the new customer engagement paradigm stand to gain a sustainable market lead. As they improve customer experience and cross the bar set by the digital beacons, they will be positioned to recapture lost customer trust. In Celent’s research, we found that while most banked adults trust that their money is safe (transactional trust), a minority actually believe their bank knows them and has their back (advisory trust). Today, a high level of advisory trust is the most valuable asset a bank could hope for.

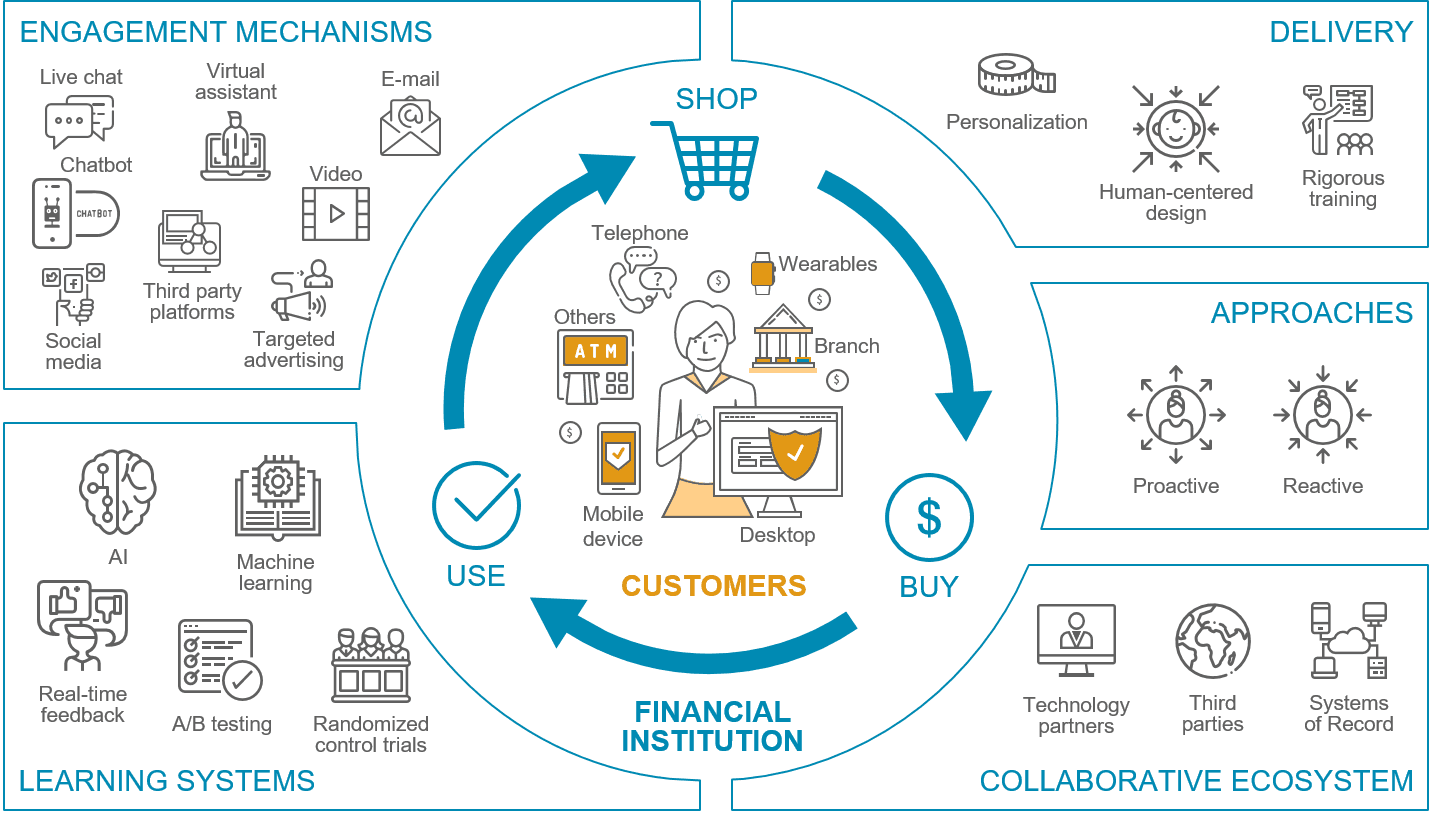

Components of the New Customer Engagement Paradigm