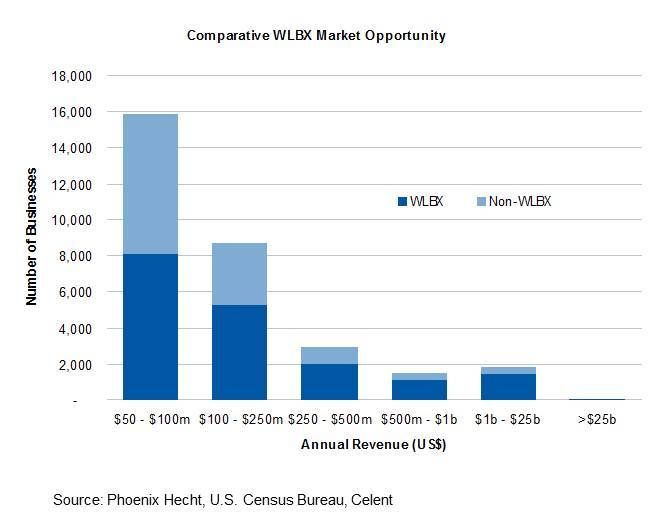

The American Banker published an unlikely article this morning. In its article written by Jackie Stuart, Maryland Bank to Use Wausau Lockbox Service, the article waxed eloquent about the benefits Sandy Spring Bank will realize with its outsourced wholesale lockbox solution. Really – wholesale lockbox making headlines? A 50 year-old product? I was encouraged to see the article for two reasons. Wholesale lockbox (WLBX) is traditionally associated with the largest banks. Sandy Spring Bank is a $3.7 billion asset financial institution. Not long ago, wholesale lockbox would be a rarity among banks of that size. Image workflow and check truncation changed all that. Now, a number of solution providers offer flexibly outsourced solutions making a wholesale lockbox product offering viable for small banks. Observing this opportunity, all leading remittance processing software platform vendors now offer outsourcing services. After all these years, the market opportunity for wholesale lockbox services remains significant. While the majority of large corporations already use bank WLBX services, WLBX adoption falls markedly with the size of business – particularly among businesses with annual revenues below US$250 million.  Processing efficiencies from image workflows and hub and spoke processing models enable lower price points than a short while ago. Moreover, since extraction and image capture can be geographically separated from lockbox processing, competition among outsource processors knows no geographic bounds either. This is good news for banks and fits well with the idea of WLBX adoption moving down market. With checks likely to dominate business-to-business payments for the medium term and WLBX is here to stay.

Processing efficiencies from image workflows and hub and spoke processing models enable lower price points than a short while ago. Moreover, since extraction and image capture can be geographically separated from lockbox processing, competition among outsource processors knows no geographic bounds either. This is good news for banks and fits well with the idea of WLBX adoption moving down market. With checks likely to dominate business-to-business payments for the medium term and WLBX is here to stay.