Life Insurance Research Outlook 2024

2024 RESEARCH THEMES

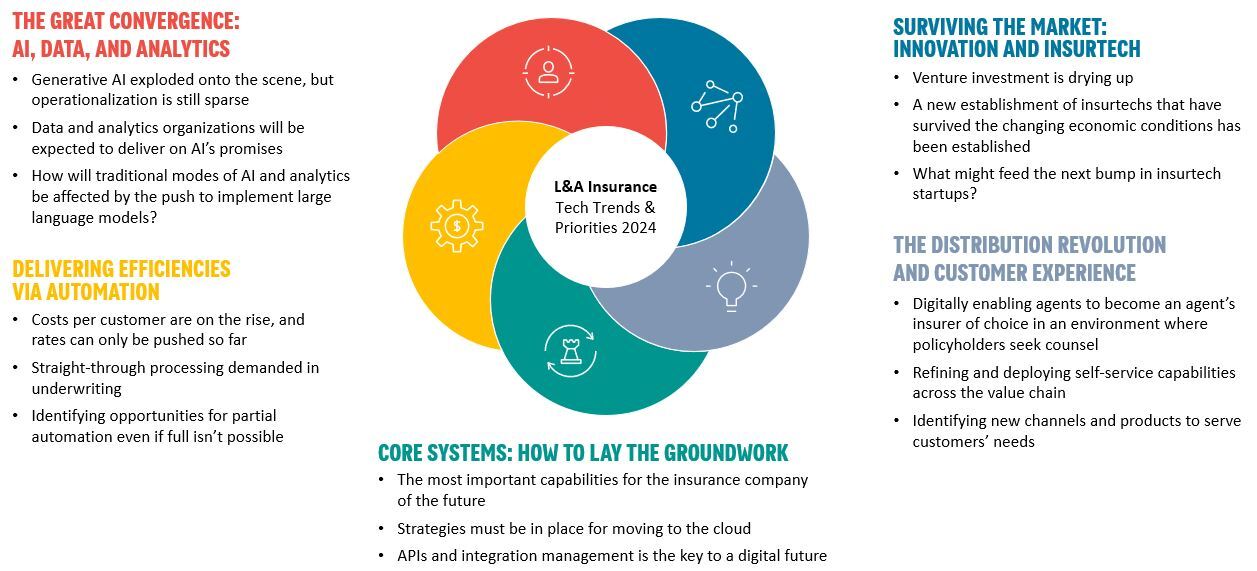

As we move further into 2024 the two big stories for life insurers are the need for growth and Generative AI. (You knew we couldn’t go even one sentence without mentioning Gen AI). Complacency remains the number one risk of the life and annuity industry. Growth is stagnant and has been for decades. Insurers have yet to find the message that makes their products desirable rather than a necessary evil – one that younger buyers ignore. Until the need is better established, the sales channels will still be agents selling rather than consumers buying, particularly online.

But in the life insurance sector, there are challenges in creating value and generating growth. Public life insurers have generally returned less than the market over the past five years and are trading at low valuations, indicating investor skepticism about their ability to generate growth and meet the cost of capital.

So, life insurers are working to shift their focus from value to growth and find ways to differentiate themselves through product innovation and distribution. However, many insurers are hindered by their focus on returning capital to shareholders, which makes it difficult to convince investors to retain more money for investment in uncertain areas.

Top priorities such as customer experience, acquisition, retention, and loyalty will continue to be a high priority as insurers look for ways to use technology to differentiate and focus on the continuous evolution of the digital experience. With the growing importance of wellness and preventative healthcare, many insurers are looking at expanding their offerings beyond traditional life insurance policies to include wellness programs and other health related services. This includes partnerships with healthcare providers and wearable technology companies to help customers track their health and make lifestyle changes that can reduce their risk of illness or injury.

The technology implications of improving results heavily rely on an increased use of data and many insurers are investing in analytics and planning significant enhancements to analytics/AI. While Gen AI isn’t the only story when it comes to data, Gen AI has the potential to transform the industry. Insurers can leverage Gen AI to improve operational efficiency, enhance underwriting practices, and deliver personalized customer experiences. However, many insurers are still in the early stages of exploring and implementing Gen AI initiatives. There is a need for top-down leadership and a culture that embraces innovation to fully realize the potential of Gen AI in the P&C insurance industry.

Regulatory changes are also having an increased impact on life insurers. New rules and requirements to protect consumers and ensure the financial stability of insurance companies includes stricter capital requirements, greater transparency around pricing and fees and new rules governing data privacy. As a result, insurers are investing more in cybersecurity, compliance and risk management and are exploring new business models and partnerships to help them navigate the changing landscape.

Innovation and continuous technology transformation are other areas insurers must stay acutely focused on to keep pace and differentiate themselves from the competition and to protect margins.

The areas of research that we’re working on for this quarter are critical areas that we suggest insurers consider to optimize the value of their technology investments.

Contact us for more information about what we have planned in Q2.

If you are a client, please sign in to access a detailed view of our 2024 agenda.