Payments in India Going the e-Way

Abstract

Payments in India Going e-Way

At a rapid pace, the Indian payments system is transforming from paper to electronic. The retail epayments market is likely to grow nearly 70 percent in the next two years. The value of retail e-payments should reach US$150 billion to $180 billion by 2010.

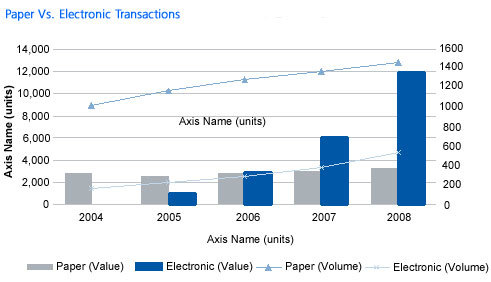

Increasing awareness and adaptability of various electronic channels has resulted in 60 percent growth in Indian e-payments over the last three years. A new Celent report, Payments in India Going e-Way, examines the constant innovation, adoption, and implementation of electronic mechanisms in the Indian payments system. Although the system is still dominated by paper-based transactions, there is great potential for a transition to electronic payments. Electronic transactions currently account for just 37 percent of total payments by volume. However, over 75 percent of payment value is electronic.

"The payment system in India has seen unmatched growth since the inception of electronic payment mechanisms," says Prathima Rajan, analyst at Celent and author of the report. "The introduction of various kinds of payment mechanisms into the retail payments space has ensured more timely and efficient completion of financial transactions," she adds.

With the growth of e-payments has come the increased usage of plastic payment cards. India has been one of the fastest growing countries for payment cards in the Asia-Pacific region. The country currently has approximately 130 million cards (both debit and credit) in circulation. Celent estimates that the number of cards in circulation will hit 210 million by 2010, with 169 million coming from debit cards and about 40 million from credit cards. However, credit cards will overtake debit cards in terms of transaction value as customers continue to use credit cards for purchases and bill payments.

This report analyses the payment patterns of Indian customers and looks at the potential for growth in the number of e-payment transactions. The report highlights the value proposition of banks outsourcing payment processing to various third party vendors. It also looks at the latest electronic payment mechanisms, such as card-based payments (smart cards and contactless cards), online payments, m-payments, POS terminals, etc. The report evaluates the market share of various players, including banks, non-banks, and other third party vendors in terms of payment processing, and profiles three major third party payment vendors.

The 40-page report contains 17 figures and eight tables. A table of contents is available here.

Members of Celent's Retail and Business Banking and Corporate Banking research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.