The European Family Office Market: Where Is the Opportunity?

Abstract

New York, NY, USA July 18, 2008

The family office market is still underrepresented in Europe, with an average penetration rate of 18% of ultra-wealthy individuals. However, the market is poised for rapid expansion due to a high concentration of wealth in the region as well as a significantly underserved ultra-high net worth population.

The European high net worth market represents nearly 27% of total wealth and has been growing at a consistent 8% rate in the last two to three years. In ?, Celent provides a broad overview of this industry. The report sketches the taxonomy of family offices and the services they provide and explores the role of technology within the market. It also examines the family office markets in Austria, Benelux, Germany, Spain, and Switzerland.

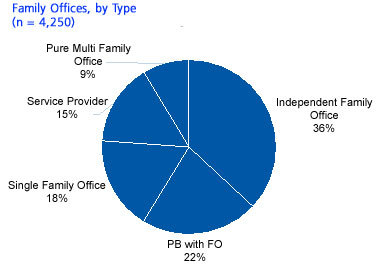

Family offices are most often categorized based on the number of families they serve and on their ownership structure. For this report, Celent divides family offices into three main categories: single family offices, multi-family offices, and family office service providers. With a total of 1,920 multi-family offices (MFOs) in Europe, or 45% of the family office market, MFOs represent the strongest growth among the different types of family offices in Europe.

"The European market is less mature than the US and is still very differentiated," says Isabella Fonseca, Celent senior analyst and co-author of the report."

Of the markets evaluated, Switzerland is the most developed and still shows high potential; it has the highest presence of independent MFOs, and many of its single family offices are rapidly evolving towards the multi-family office model," she adds.

This report is a guide for firms interested in targeting high net worth individuals with family office services. The study highlights current family office models and their success factors, as well as major threats and challenges.

The report is 32 pages long and contains 12 figures and 11 tables. A table of contents is available online.

Members of Celent's Wealth Management research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.